FINANCIAL MANAGEMENT

Capital Structure Theories

Capital structure may be defined as a combination of debt capital and equity capital of a corporate entity (business firm). Optimum capital structure may be defined as that capital structure or combination of debt capital and equity capital which leads to the minimum overall cost of capital (k o) and maximum value of the business firm (corporate entity).

The four major capital

structure theories are:

1. Net income approach,

2. Net operating income approach,

3. Modigliani – Miller (MM) approach,

4. Traditional approach.

General

assumptions for capital structure theories:

1.

There are only

two sources of funds used by a business firm: perpetual risk free debt and

ordinary (equity) shares.

2.

The Dividend Payout Ratio is 100%.

3.

The firm’s total assets are

given and do not change (i.e. Total Assets are constant).

4.

The firm’s total

capital (i.e. equity + debt) remains constant. It can change its degree

of financial leverage (i.e. capital structure) either by selling shares and

using the proceeds to retire debentures or by raising more debt capital to

reduce the equity capital.

5.

The operating profits

(EBIT) are not expected to grow (i.e. EBIT is constant).

6.

All investors have the same

expectation of the firm’s future EBIT.

7.

The firm’s business risk is

constant over a period of time and is assumed to be independent of its capital

structure and financial risk.

8.

The firm’s life is perpetual.

Net income approach

According to the net income (NI) approach the capital

structure decision is relevant to the valuation of the firm. A change

in the capital structure will lead to a corresponding change in the overall

cost of capital as well as the total value of the firm. If the degree of

financial leverage as measured by the ratio of debt to equity is increased the

weighted average cost of capital will decline, while the total value of the

firm as well as the market price of equity shares will increase. Conversely, a

decrease in the degree of financial leverage will cause an increase in the

overall cost of capital and a decline both in the total value of the firm as

well as the market price of equity shares.

Specific

assumptions:

1.

Cost of debt is less than

cost of equity (i.e. k d < ke).

2.

Due to change in the degree

of financial leverage, there will be no change in either the cost of debt or

the cost of equity (i.e. k d and ke are

constant).

3.

There are no

corporate taxes.

4.

Any change in the degree of

financial leverage of the firm does not change the risk perception of the

investors about the firm.

Net operating income approach

According to the net operating income (NOI) approach

the capital

structure decision is irrelevant to the valuation of the firm. A change

in the capital structure will not lead to any change in the total value of the

firm and the market price of equity shares, as the overall cost of capital is

independent of the degree of financial leverage (i.e. capital structure).

Specific

assumptions:

1.

The overall cost of capital

(k o) and cost of debt (k d) of the firm remain constant

for all the degrees of financial leverage i.e. for all the capital structures (k o

and k d are constant).

2.

Cost of debt is less than

cost of equity (i.e. k d < ke).

3.

The market

value of equity (S) is a residual value which is determined by

deducting the total market value of debt (B) from

the total market value of the firm (V). Symbolically, S = V – B.

4.

The cost of equity capital

(ke) increases with the increase in the degree of financial leverage

(ratio of debt to equity).

5.

There are no

corporate taxes.

Modigliani – Miller approach

The Modigliani – Miller (MM) approach in respect of

the relationship between the capital structure, cost of capital and value of

the firm is akin to the NOI approach. The propositions of the MM approach may

be stated as follows:

Initial proposition (if

there are no corporate taxes):

The overall cost of capital (k o) and the

value of the firm (V) are independent of its capital structure. K o

and V are constant for all degrees of financial leverage (i.e. capital

structures).

Modified proposition (if

there is corporate taxes):

(i) Overall cost of capital (k o) can be

lowered by increasing the degree of financial leverage of the firm;

(ii) Value of the firm (V) can be increased by

increasing its degree of financial leverage.

Specific

assumptions (for initial proposition):

MM proposition that weighted average cost of capital

(k o) and the value of the firm (V) are constant irrespective of the

type of capital structure is based on the following assumptions:

1.

There is no

corporate tax in the system.

2.

Capital markets are perfect implying that –

(a) Securities are infinitely divisible,

(b) Investors are free to buy or sell securities,

(c) Investors can borrow without restrictions on the same

terms and conditions as firms can,

(d) There are no transaction costs,

(e) Each investor has the same information which is

readily available to him without cost,

(f) Investors are rational and behave accordingly.

3.

All investors have the same

expectation of the firm’s net operating income (EBIT) on the basis of which the

value of the firm is to be determined.

4.

Business risk is equal

among all the firms with similar operating environment.

5.

The dividend payment ratio is 100%.

Traditional approach

The traditional approach is midway between the NI and

NOI approaches. It partakes of some features of both these approaches. While

the traditional approach supports the proposition that the capital structure

decision is relevant to the overall cost of capital and total value of the

firm, it does not subscribe to the view that the value of the firm will

necessarily increase for all increases in the degree of financial leverage at

all levels of activity. The traditional approach, on the contrary, has divided

the impact of the degree of financial leverage on the overall cost of capital

in three stages as follows:

First Stage:

At the initial stage, the cost of equity capital

remains constant or rises slightly with an increase in debt capital. Again, at

this stage, the cost of debt capital also remains constant or rises negligibly

since the market views the use of debt as a reasonable policy. As a result, the

weighted average cost of capital will fall and the value of the firm will

increase with an increase in debt-equity ratio.

Second Stage:

After a certain degree of financial leverage, the cost

of equity capital will tend to rise because of the increased risk perception of

the equity shareholders. At this stage, the increase in the cost of equity (due

to added financial risk arising out of higher degree of financial leverage)

will just offset the benefit of using cheaper debt capital. It will continue up

to a certain range of the degree of financial leverage. Hence, within

this range of the degree of financial leverage, the weighted average cost of

capital will remain unchanged. The weighted average cost of capital will be the

minimum at this stage and hence, the value of the firm will be the maximum.

So, this range of the degree of financial leverage would be regarded as the

optimum degree of financial leverage.

Third Stage:

At this stage, if the degree of financial leverage of the firm is increased beyond the range as shown in the second stage, the risk perception of the debt holders will also rise. At the same time, the cost of equity capital will rise at higher pace because the equity shareholders will perceive a high degree of financial risk and hence, demand a higher equity capitalisation rate. Thus, the rise in the cost of equity capital will offset the advantage of low-cost debt capital. As a result, the weighted average cost of capital will rise and the value of the firm will decrease with an increase in debt-equity ratio.

Important Formulas

|

|

Net Income

(NI) Approach |

|

|

1 |

Market value of the firm, V |

= S + B |

|

2 |

Market value of each Eq. share, Po |

= EPS1 ÷ ke [EPS1 = Expected earnings per

share] |

|

3 |

Market value of the Eq. capital, S |

[(EBIT – I) × (1 – t)] ÷ ke |

|

4 |

Market value of the debt capital, B |

= I ÷ k d [Here, k d = Before-tax cost of

debt] |

|

5 |

Overall cost of capital, k o |

= k d x (B ÷ V) + ke x

(S ÷ V) [Here, k d = After-tax cost of

debt] |

|

|

|

|

|

|

Net Operating

Income (NOI) Approach |

|

|

6 |

Market value of the firm, V |

= EBIT ÷ ko |

|

7 |

k o |

= EBIT ÷ V |

|

8 |

Market value of the debt capital, B |

= I ÷ k d [Here, k d = Before-tax cost of

debt] |

|

9 |

Market value of total Eq. capital, S |

= V – B |

|

10 |

Cost of equity capital, k e |

= [(EBIT – I) ÷ S |

|

11 |

Cost of equity capital, k e |

= k o + (k o – k d)

(B ÷ S) [Here, k o and k d are

constant] |

|

|

|

|

|

|

Modigliani –

Miller (MM) Approach (Assuming

existence of corporate tax) |

|

|

12 |

Value of unlevered firm, VU |

= [EBIT x (1 – t)] ÷ k o |

|

13 |

Value of levered firm, VL |

= VU + B x t |

|

14 |

Value of levered firm, VL |

= [{EBIT x (1 – t)} ÷ k o] + B x t [Here, Ko = ke] |

|

15 |

k o (unlevered firm) |

= ke |

|

16 |

k o (levered firm) |

= k d x (B ÷ V) + ke x

(S ÷ V) |

|

17 |

ke (levered firm) |

= [(EBIT – I) (1 – t)] ÷ S = EAT ÷ S [Here, S = VL – B] |

|

18 |

K d |

= After-tax cost of debt |

Arbitrage Process

The term arbitrage refers to an act of selling an

asset/security in one market (at higher price) and buying it in another (at

lower price), while absolute amount of return to the investor remains the same. As a result, equilibrium is restored in the market

price of the security in different markets. In relation to the Modigliani -

Miller (MM) approach, the essence of the arbitrage process is “selling

of securities of one firm at higher prices and purchasing of securities of

another firm at lower prices maintaining the same absolute amount of return

even after switching of the investment from one firm to another”, where

the firms, belonging to the same risk class, are identical in all respects

except for the difference in their respective capital structures.

According to Modigliani − Miller (MM) approach the

market value of a firm (V) is independent of its capital structure. In other

words, as an extension of the MM approach, it can be said that two firms

belonging to the same risk class and identical in all respects except for the

difference in their respective capital structures cannot have different market

values. Modigliani and Miller also said that the values of the homogeneous

firms, which differ only in respect of leverage, cannot be different, because

of the operation of arbitrage. The investors of the firm whose value is higher

(levered firm) will sell their shares and instead buy the shares of the firm

whose value is lower (unlevered firm). In this arbitrage process the investors

will be able to earn the same return at lower outlay with the same perceived

risk i.e. they would be better off because an investor would borrow at the same cost and in the same proportion of the degree of

leverage present in the high value (levered) firm, shares of which he would

be selling. The behaviour of the investors will have the effect of - (i) increasing

the share prices (value) of the firm whose shares are being purchased; and (ii)

lowering the share prices (value) of the firm whose shares are being sold. This

will continue till the market values (V) of the two firms become identical and

the overall costs of capital (k o) are the same. The use of debt by

the investor for the arbitrage process is called home-made leverage or personal

leverage.

Part B

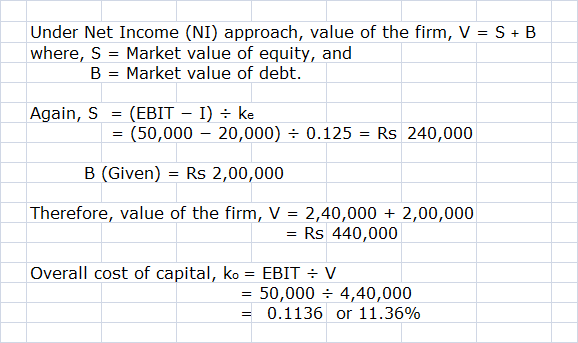

Illustration: 1

A company’s expected annual net

operating income (EBIT) is Rs 50,000. The company has Rs 2, 00,000 10%

debentures. The equity capitalisation rate (Ke) of the company is 12.5%. Find

the value of the firm and overall cost of capital under Net Income approach.

Illustration: 2

Assuming no taxes and given the earnings before

interest and taxes (EBIT), interest (I) at 10% and equity capitalisation rate (Ke) below, calculate the total market value of each firm

under Net Income Approach:

|

Firms |

EBIT

(Rs) |

Interest

(Rs) |

ke |

|

X |

2,00,000 |

20,000 |

12% |

|

Y |

3,00,000 |

60,000 |

16% |

|

Z |

5,00,000 |

2,00,000 |

15% |

|

W |

6,00,000 |

2,40,000 |

18% |

Also determine the weighted average

cost of capital (k o) for each firm.

Illustration: 3

The existing capital structure of XYZ Ltd. is as under:

|

|

Rs |

|

Equity Shares of Rs 100 each |

40,00,000 |

|

Retained Earnings |

10,00,000 |

|

9% Preference Shares |

25,00,000 |

|

7% Debentures |

25,00,000 |

The existing rate of return on the

company’s capital is 12% and the income-tax rate is 50%.

The company requires a sum of Rs 25, 00,000 to finance

an expansion programme for which it is considering the following alternatives:

i.

Issue of 20,000 equity shares at a premium of Rs 25

per share.

ii.

Issue of 10% preference shares.

iii.

Issue of 8% debentures.

It is estimated that the PE ratios in the cases of

equity, preference and debenture financing would be 20, 17 and 16 respectively.

Which of the above alternatives would

you consider to be the best?

Illustration: 4

XL Limited provides you with following figures:

|

|

Rs |

|

Profit (EBIT) |

2,60,000 |

|

Less: Interest on Debentures @ 12% |

60,000 |

|

EBT |

2,00,000 |

|

Less: Income tax @ 50% |

1,00,000 |

|

EAT / PAT |

1,00,000 |

|

Number of Equity shares (of Rs 10 each) |

40,000 |

|

Earnings per share (EPS) |

2.50 |

|

Ruling market price of each equity

share |

25 |

|

P/E Ratio (i.e. Market Price

/ EPS) |

10 |

The Company has undistributed reserves of Rs 6,

00,000. The company now needs Rs 2, 00,000 for expansion. This amount will earn

at the same rate as funds already employed. You are informed that a debt equity

ratio Debt / (Debt+ Equity) more than 35% will push the P/E Ratio down to 8 and

raise the interest rate on additional amount borrowed to 14%.

You are required to ascertain the probable price of

the share –

i. If the

additional funds are raised as debt; and

ii. If the amount

is raised by issuing equity shares.

Illustration:

5

From the following data find out the value of each

firm and value of each equity share as per the Modigliani-Miller approach:

|

|

P |

Q |

R |

|

EBIT |

13,00,000 |

13,00,000 |

13,00,000 |

|

No. of shares |

3,00,000 |

2,50,000 |

2,00,000 |

|

12% debentures |

|

9,00,000 |

10,00,000 |

Every firm expects a 12%

return on investment.

Illustration:

6

Companies X and Y are in the same risk class, and are

identical in every fashion except that Company X uses debt while Company Y does

not. The levered firm has Rs 9, 00,000 debentures, carrying 10% rate of

interest. Both the firms earn 20% before interest and taxes on their total

assets of Rs 15 lakhs. Assume perfect capital markets, rational investors and

so on; a tax rate of 50% and capitalisation rate of 15% for an all equity

company.

a) Compute the value of firms X

and Y using the net income (NI) approach.

b) Compute the value of each firm

using the Modigliani – Miller (MM) approach.

c) Using the MM approach,

calculate the overall cost of capital (k o) for firms X and Y.

d) Which of these two firms has an

optimal capital structure according to the MM approach? Why?

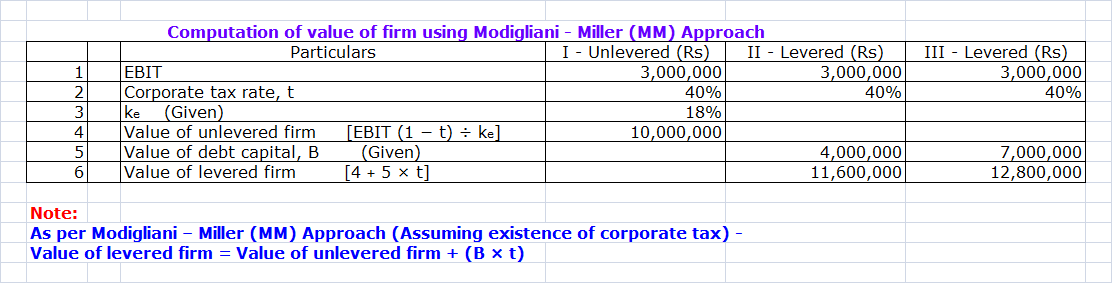

Illustration: 7

Merry

Ltd. has earnings before interest and taxes (EBIT) of Rs 30, 00,000 and a 40% tax rate. Its required rate of

return on equity in the absence of borrowing is 18%. What is the value of the

company under Modigliani – Miller approach (i) with no leverage; ii) with Rs 40,00,000

in debt, and iii) with Rs 70,00,000 in debt?

Illustration: 8

Companies X and Y are identical in all respects including

risk factors except for debt/equity ratio. Company X is having issued 10%

debentures of Rs 18 lakhs while Company Y has issued only equity. Both

the companies earn 20% before interest and taxes on their total assets of Rs 30

lakhs.

Assuming a tax rate of 50% and capitalisation rate of

15% for an all-equity company, compute the value of companies X and Y using i)

Net Income Approach and ii) Net Operating Income Approach.

Solution: 8

No comments:

Post a Comment