FINANCIAL MANAGEMENT

Fund Flow Analysis

Part A: Discussion of basic theories including various methods and techniques of preparing the Funds Flow Statement and explanation of important definitions and points relevant to analysing the funds flow of a business enterprise effectively in order to preparing the Funds Flow Statement most appropriately.

Part B: 7 Illustrations with solutions

Part A

Definitions

Fund is the other name of working capital.

We know that working capital is the excess of the

value of current assets (including loans and advances) over the value of

current liabilities (including provisions). Therefore, fund can

also be defined as the capital which is not fixed and which is required for

running the business operations on day to day basis.

Fund flow implies the difference between the opening balance and the

closing balance of fund with respect to an accounting year.

If the closing balance of fund is less than the opening balance, it can be

termed as outflow of fund over the

period of the accounting year. On the other hand, if the closing balance of fund

is more than the opening balance, it can be termed as inflow of fund.

Fund flow analysis implies a systematic analysis of the fund flow to

identify the reasons of increase or decrease in the balance of fund over the

period of the accounting year.

Technique of fund flow analysis

Technique

of fund flow analysis involves following three steps:

1. Preparation of statement showing computation of funds from operations;

2. Preparation of statement showing changes in working capital; and

3. Preparation of funds flow statement.

Step: I

Preparation of statement showing computation

of funds from operations

Funds from operations can be computed either in direct method or in indirect method.

Direct method:

Statement

showing computation of funds from operations

|

|

Particulars |

Rs |

Rs |

|

|

Sales |

|

××× |

|

LESS |

Raw

materials consumed |

××× |

|

|

LESS |

Power

and fuel |

××× |

|

|

LESS |

Wages,

salaries and bonus |

××× |

|

|

LESS |

Workmen

and staff welfare expenses |

××× |

|

|

LESS |

Repairs

and maintenance |

××× |

|

|

LESS |

Brokerage

and commission |

××× |

|

|

LESS |

Insurance

premium |

××× |

|

|

LESS |

Rent,

rates and taxes |

××× |

|

|

LESS |

Contribution

to provident fund |

××× |

|

|

LESS |

Contribution

to superannuation fund |

××× |

|

|

LESS |

Pension

and gratuity |

××× |

|

|

LESS |

Research

and development |

××× |

|

|

LESS |

Travelling

expenses |

××× |

|

|

LESS |

Directors’

fees |

××× |

|

|

LESS |

Audit

fees |

××× |

|

|

LESS |

Turnover

tax |

××× |

|

|

LESS |

Sales

tax |

××× |

××× |

|

|

Funds from

operations |

|

××× |

Note:

Items

like depreciation, provision for bad and doubtful debts, losses and gains of

non-trading nature, write offs, interest on debentures and loans, etc. are not

to be considered while calculating the funds from operations under direct

method.

Indirect method:

Statement

showing computation of funds from operations

|

|

Particulars |

Rs |

Rs |

|

|

Net

profit for the year ended.........(as per the balance sheet) |

|

××× |

|

ADD |

Transfer

to General Reserve, DRR, W C Reserve |

××× |

|

|

ADD |

Proposed

dividend of current year (if appears in balance sheet) |

××× |

|

|

ADD |

Interim

dividend paid |

××× |

|

|

ADD |

Preference

dividend paid |

××× |

|

|

ADD |

Provision

for tax (provision made during the current year) |

××× |

××× |

|

|

Net profit before tax |

|

××× |

|

ADD |

Depreciation

on fixed assets |

××× |

|

|

ADD |

Loss

on sale of fixed assets |

××× |

|

|

ADD |

Goodwill

written off |

××× |

|

|

ADD |

Preliminary

expenses written off |

××× |

|

|

ADD |

Interest

on debentures, loans and public deposits (treated

as non-operating expense) |

××× |

|

|

ADD |

Loss

on sale of long term investments |

××× |

|

|

ADD |

Discount

on issue of shares/debentures written off |

××× |

|

|

ADD |

Premium

on redemption of debentures/ preference shares |

××× |

××× |

|

|

|

|

××× |

|

LESS |

Profit

on sale of fixed assets |

××× |

|

|

LESS |

Profit

on sale of long term investments |

××× |

|

|

LESS |

Dividend

on investments in shares |

××× |

|

|

LESS |

Interest

on investments in debentures |

××× |

|

|

LESS |

Discount

on redemption of debentures/ preference shares |

××× |

××× |

|

|

Funds from

operations |

|

××× |

Step: II − Preparation of statement showing

changes in working capital

Statement

showing changes in working capital

|

Particulars |

Previous

Year (Rs) |

Current

Year(Rs) |

Increase

in W.C. (Rs) |

Decrease

in W.C. (Rs) |

|

Current Assets: |

|

|

|

|

|

Closing

stock (net of provision) |

××× |

××× |

××× |

××× |

|

Sundry

debtors (net of provision) |

××× |

××× |

××× |

××× |

|

Marketable

securities (short-term

investments) |

××× |

××× |

××× |

××× |

|

Accrued

incomes |

××× |

××× |

××× |

××× |

|

Cash

at bank / hand |

××× |

××× |

××× |

××× |

|

Loans

and advances |

××× |

××× |

××× |

××× |

|

Bills

receivable |

××× |

××× |

××× |

××× |

|

Prepaid

expenses |

××× |

××× |

××× |

××× |

|

TOTAL (A) |

××× |

××× |

|

|

|

Current Liabilities: |

|

|

|

|

|

Sundry

creditors |

××× |

××× |

××× |

××× |

|

Bills

payable |

××× |

××× |

××× |

××× |

|

Outstanding

expenses |

××× |

××× |

××× |

××× |

|

Incomes

received in advance |

××× |

××× |

××× |

××× |

|

Bank

overdraft |

××× |

××× |

××× |

××× |

|

TOTAL (B) |

××× |

××× |

|

|

|

Working

Capital (A – B) |

××× |

××× |

|

|

|

Increase / Decrease in W.C. |

××× |

××× |

××× |

××× |

|

|

××× |

××× |

××× |

××× |

Step: III − Preparation of funds flow

statement

Funds flow

statement for the year ended........................

|

Sources |

Rs |

Applications |

Rs |

|

Funds

from operations |

××× |

Funds

lost in operations |

××× |

|

Issue

of share capital |

××× |

Redemption

of preference shares |

××× |

|

Issue

of debentures |

××× |

Redemption

of debentures |

××× |

|

Raising

other long term loans |

××× |

Repayment

of long term loans |

××× |

|

Sale

of fixed assets |

××× |

Buy-back

of equity shares |

××× |

|

Sale

of investments |

××× |

Purchase

of fixed assets |

××× |

|

Dividend

received |

××× |

Purchase

of investments |

××× |

|

Interest

received |

××× |

Payment

of proposed dividend of previous year |

××× |

|

Decrease

in working capital |

××× |

Payment

of interim dividend |

|

|

|

|

Payment

of interest (treated

as non-operating expense) |

××× |

|

|

|

Payment

of tax (treated

as non-current item) |

××× |

|

|

|

Increase

in working capital |

××× |

|

|

××× |

|

××× |

Some Important Points / Explanations:

1. Current Investments

Current investments are considered as part of working capital.

2. Treatment of bank overdraft and cash credit

Bank overdraft and cash credit are to be treated as short-term

borrowings and should be considered as part of current liabilities.

3. Provision against current assets

Very

often provision is made for doubtful debts and obsolescence or loss in the

value of inventory. In such cases the concerned item of current

asset should be shown net of provision in the “Statement showing changes in

working capital”.

4. Treatment of bad debts

Bad

debts written off during the year may be added

back to the closing balances of provision for doubtful debts and trade

receivables. Alternatively,

the adjustment of writing off of bad debts may be ignored and

the solution can be given on the basis of the closing balances of provision for

doubtful debts and trade receivables as appearing in the balance sheet without

adding back the bad debts written off during the year to the said closing

balances.

5. Purchasing a business by issue of fully paid shares

If

assets and liabilities of another company are purchased by issuing fully paid

shares, the entire amount of issue of shares

against the business purchase should be shown as source of fund and acquisition of fixed assets should be

shown as application of fund. The “Statement showing changes in working

capital” will be prepared as usual.

6. Treatment of proposed dividend

(a) Dividend proposed for the previous year will be an application of fund, unless otherwise stated, on the assumption that the proposed amount has been approved by the shareholders in the AGM.

(b) No effect is given to Proposed Dividend for the current year as it is not provided for and is a contingent liability.

(c)

Any unpaid dividend is transferred to Dividend Payable

A/c / Unpaid Dividend A/c which is shown in the Balance Sheet of the current

year as Other Current Liabilities under Current Liabilities.

7. Interest on debentures and loans

As

advocated by The Institute of Chartered Accountants of India (ICAI) in AS3 – Cash Flow Statement, it has to be

added back in the “Statement showing computation of funds from operations” and

then payment of interest has to be shown as application of fund in the “Funds

flow statement”.

8. Unclaimed dividend

It

is the dividend which could not be distributed by the company due to shareholders’

indifference such as non-presenting the dividend warrant to bank or change of address

without intimation to the company, etc. In the balance sheet unclaimed dividend

is shown under the head “Current Liabilities” so long as it is not claimed.

Like

proposed dividend, unclaimed dividend can also be treated either as current

liability or as noncurrent liability. If

it is treated as current liability, it will be shown in the “Statement showing

changes in working capital” like other current liabilities. In that case, no

further treatment will be required for this, either in the “Statement showing

computation of funds from operations”, or in the “Funds flow statement”.

If unclaimed dividend is treated as non-current liability,

it will not be shown in the “Statement showing changes in working capital”. In

this case, there may be two different situations

requiring two different accounting treatments.

Situation: I

If the balance of unclaimed dividend at the end of the current year is more than the balance at the end of the previous year, the amount of increase will be transferred to the proposed dividend account by making the following journal entry:

|

Date |

Particulars |

L.F. |

Debit (Rs) |

Credit (Rs) |

|

|

Proposed

dividend A/c Dr |

|

|

|

|

|

To Unclaimed dividend A/c |

|

|

|

|

|

(Increase

in unclaimed dividend during the current year transferred to Proposed

Dividend Account) |

|

|

|

Under

this situation, the amount of proposed dividend (of the previous year) paid

during the current year will be assumed to be the amount as reduced by the

amount of increase in the balance of unclaimed dividend.

Situation: II

If the balance of unclaimed dividend at the end of the current year is less than the balance at the end of the previous year, the amount of decrease will be assumed to be the amount of unclaimed dividend (of the previous year) paid during the current year. The necessary journal entry made for such payment of unclaimed dividend was:

|

Date |

Particulars |

L.F. |

Debit (Rs) |

Credit (Rs) |

|

|

Unclaimed

dividend A/c Dr |

|

|

|

|

|

To Bank A/c |

|

|

|

|

|

(Amount

of unclaimed dividend of the previous year paid during the current year) |

|

|

|

9. Goods lost in transit

It

is an abnormal (i.e. non-operating) event. So it has to be added back in the

“Statement showing computation of funds from operations”. Then it has to be

shown as application of fund in the “Funds flow statement”.

Part B

Illustration: 1

From the following Balance Sheets of

Priceless Ltd. prepare Funds Flow Statement for the year 2016.

Balance sheets as at (Rs in ’000)

|

Liabilities |

31.3.15 |

31.3.16 |

Assets |

31.3.15 |

31.3.16 |

|

Equity sh. capital |

150 |

200 |

Goodwill |

50 |

40 |

|

9% Red. Pref. sh. cap |

75 |

50 |

Land & Building |

100 |

85 |

|

Capital Reserves |

- |

10 |

Plant & Machinery |

40 |

100 |

|

General Reserves |

20 |

25 |

Investments |

10 |

15 |

|

P/L Account |

15 |

24 |

Debtors |

70 |

85 |

|

Proposed Dividend |

21 |

25 |

Stock |

39 |

55 |

|

Creditors |

13 |

24 |

Bills Receivable |

10 |

15 |

|

Bills Payable |

10 |

8 |

Cash in hand |

7 |

5 |

|

Liability for Expenses |

15 |

18 |

Cash at bank |

5 |

4 |

|

Provision for tax |

20 |

25 |

Preliminary Expenses |

8 |

5 |

|

|

339 |

409 |

|

339 |

409 |

Additional information:

1. A part of land was sold out in

2016, and the profit was credited to Capital Reserve.

2. A machine has been sold for Rs 5,000

(written down value of the machinery was Rs 6,000). Depreciation of Rs 5,000

was charged on plant in 2016.

3. An interim dividend of Rs 10,000

has been paid in 2016.

4.

An Amount of Rs 1,000 has been received as dividend on

investment in 2016.

Solution: 1

Illustration: 2

The Balance Sheets of Pinnacle

Corporation as at the end of 2015 and 2016 are given below:

|

Liabilities |

2015

(Rs) |

2016

(Rs) |

Assets |

2015

(Rs) |

2016

(Rs) |

|

Share capital |

1,00,000 |

1,50,000 |

Freehold land |

1,00,000 |

1,00,000 |

|

Share premium |

- |

5,000 |

Plant at cost |

1,04,000 |

1,00,000 |

|

General Reserves |

50,000 |

60,000 |

Furniture at cost |

7,000 |

9,000 |

|

P/L Account |

10,000 |

17,000 |

Investments |

60,000 |

80,000 |

|

6% Debentures |

70,000 |

50,000 |

Debtors |

30,000 |

70,000 |

|

Provision for dep. (on plant) |

50,000 |

56,000 |

Stock |

60,000 |

65,000 |

|

Provision for dep. (on Furniture) |

5,000 |

6,000 |

Cash |

30,000 |

45,000 |

|

Provision for taxation |

20,000 |

30,000 |

|

|

|

|

Creditors |

86,000 |

95,000 |

|

|

|

|

|

3,91,000 |

4,69,000 |

|

3,91,000 |

4,69,000 |

A plant purchased for Rs 4,000

(Depreciation provided Rs 2,000) was sold for Rs 800 on 30th

September, 2015. On 30th June, 2015 an item of furniture was

purchased for Rs 2,000. These were the only transactions concerning fixed

assets during 2015. A dividend of 22½ % on original shares was paid. You are

required to prepare funds Flow Statement and verify the results by preparing a

schedule of changes in Working Capital.

Solution: 2

Illustration: 3

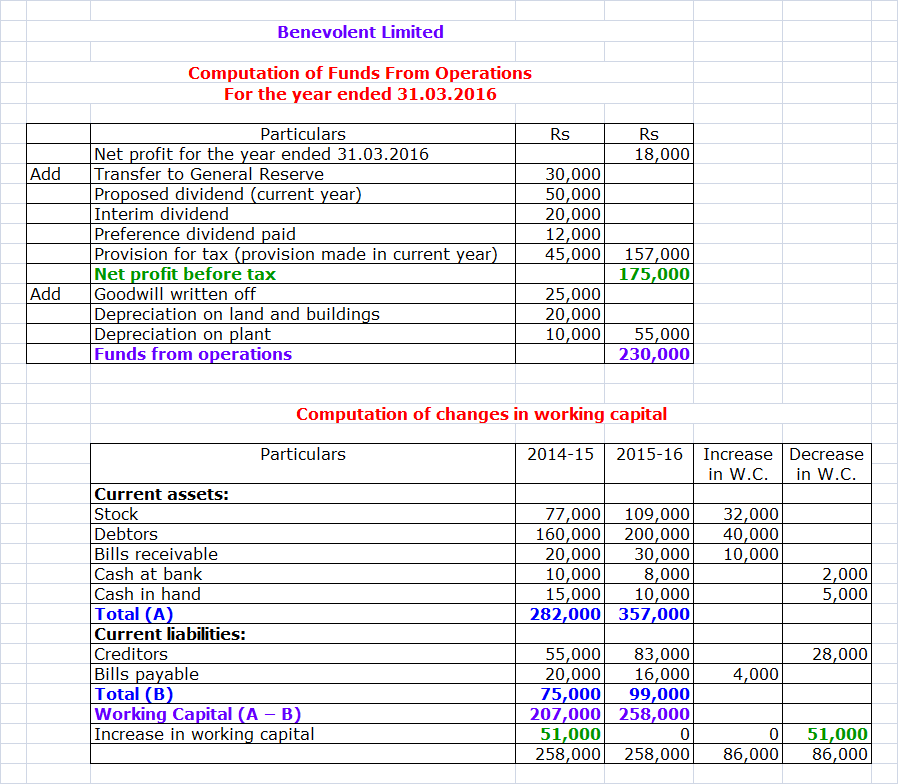

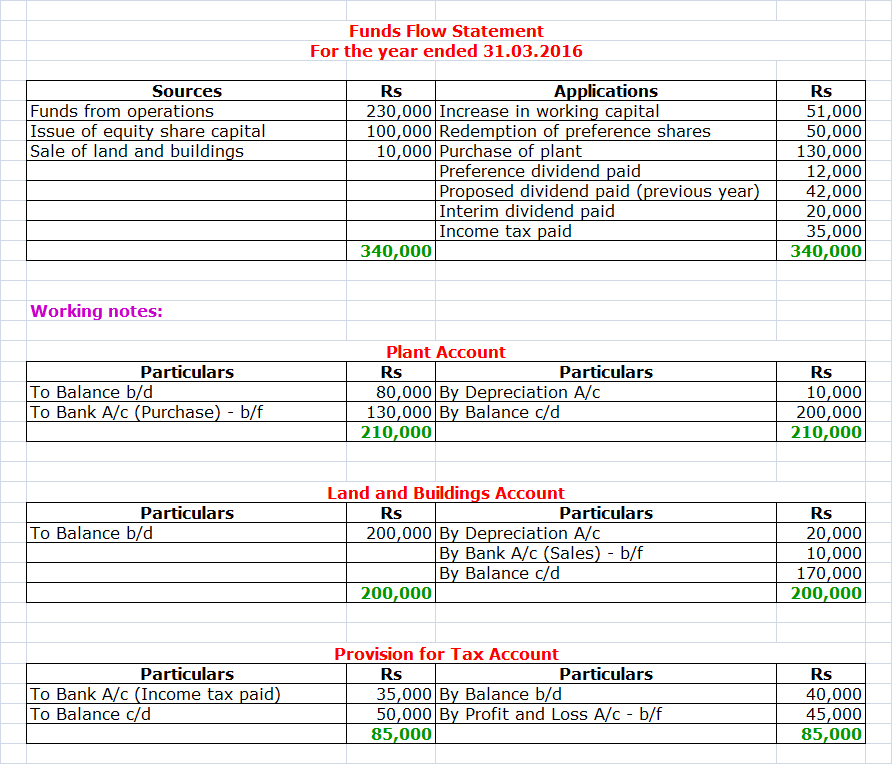

From the Balance Sheet of

Benevolent Ltd., please prepare:

A. A Statement of changes in

the Working Capital.

B. Funds Flow Statement.

Balance Sheet at

|

|

31st

March |

|

31st

March |

||

|

Liabilities |

2015

(Rs) |

2016

(Rs) |

Assets |

2015

(Rs) |

2016

(Rs) |

|

Equity share capital |

3,00,000 |

4,00,000 |

Goodwill |

1,15,000 |

90,000 |

|

8% Pref. Sh. Cap. |

1,50,000 |

1,00,000 |

Land & Buildings |

2,00,000 |

1,70,000 |

|

P/L Account |

30,000 |

48,000 |

Plant |

80,000 |

2,00,000 |

|

General reserves |

40,000 |

70,000 |

Debtors |

1,60,000 |

2,00,000 |

|

Proposed dividend |

42,000 |

50,000 |

Stock |

77,000 |

1,09,000 |

|

Creditors |

55,000 |

83,000 |

Bills receivable |

20,000 |

30,000 |

|

Bills payable |

20,000 |

16,000 |

Cash in hand |

15,000 |

10,000 |

|

Provision for taxation |

40,000 |

50,000 |

Cash at bank |

10,000 |

8,000 |

|

|

6,77,000 |

8,17,000 |

|

6,77,000 |

8,17,000 |

Following is the additional information

available:

i.

Depreciation of Rs 10,000 and Rs 20,000 have been

charged on Plant and Land and Buildings respectively in 2016.

ii.

Interim dividend of Rs 20,000 has been paid in 2016.

iii.

Income tax of Rs 35,000 has been paid in 2016.

Solution: 3

Illustration: 4

From the following balance sheets of Reindeers Limited prepare a statement showing the changes in the Working Capital and Funds Flow Statement during the year 2015.

Balance sheet as at

|

|

Rs |

Rs |

|

Assets: |

31.12.2014 |

31.12.2015 |

|

Fixed assets (net) |

5,10,000 |

6,20,000 |

|

Investments |

30,000 |

80,000 |

|

Current assets |

2,40,000 |

3,75,000 |

|

Discount on debentures |

10,000 |

5,000 |

|

Total |

7,90,000 |

10,80,000 |

|

Liabilities: |

|

|

|

Equity share capital |

3,00,000 |

3,50,000 |

|

Preference share capital |

2,00,000 |

1,00,000 |

|

Debentures |

1,00,000 |

2,00,000 |

|

Reserves |

1,10,000 |

2,70,000 |

|

Provision for doubtful debts |

10,000 |

15,000 |

|

Current liabilities |

70,000 |

1,45,000 |

|

Total |

7,90,000 |

10,80,000 |

You are informed that during the year:

i. A machine costing Rs 70,000

book value Rs 40,000 was disposed of for Rs 25,000.

ii. Preference share redemption was

carried out at a premium of 5%, and

iii. Interim Dividend at 15% was

paid on equity shares for the year 2014.

Further:

1.

The provision for depreciation stood at Rs 1,50,000 on

31st December, 2014 and at Rs 1,90,000 on 31st December,

2015; and

2.

Stock which was valued at Rs 90,000 as on 31st

December, 2014 was written up to its cost Rs 1,00,000 for preparing Profit and

Loss account for the year 2015.

Solution: 4

Illustration: 5

The directors of Chintamani Ltd.

present you with the Balance Sheets as on 30th June, 2015 and 2016 and ask you to

prepare statements which will show them what has happened to the money which

came into the business during the year 2016.

Balance sheet as at

|

|

Rs |

Rs |

|

Liabilities: |

30.06.2015 |

30.06.2016 |

|

Authorised capital (15,000 shares

of Rs 100 each) |

15,00,000 |

15,00,000 |

|

Paid up capital |

10,00,000 |

14,00,000 |

|

Debentures (2016) |

4,00,000 |

- |

|

General Reserves |

60,000 |

40,000 |

|

P & L Appropriation A/c |

36,000 |

38,000 |

|

Proposed dividends |

78,000 |

72,000 |

|

Sundry creditors |

76,000 |

1,12,000 |

|

Bank overdraft |

69,260 |

1,29,780 |

|

Bills payable |

40,000 |

38,000 |

|

Loans on mortgage |

- |

5,60,000 |

|

Total |

17,59,260 |

23,89,780 |

|

Assets: |

|

|

|

Land and freehold buildings |

9,00,000 |

9,76,000 |

|

Plant and machinery |

1,44,000 |

5,94,000 |

|

Fixtures and fittings |

6,000 |

5,500 |

|

Cash in hand |

1,560 |

1,280 |

|

Sundry debtors |

1,25,600 |

1,04,400 |

|

Bills receivable |

7,600 |

6,400 |

|

Stock |

2,44,000 |

2,38,000 |

|

Prepayments |

4,500 |

6,200 |

|

Shares in other companies |

80,000 |

2,34,000 |

|

Goodwill |

2,40,000 |

2,20,000 |

|

Preliminary expenses |

6,000 |

4,000 |

|

Total |

17,59,260 |

23,89,780 |

You are given the following additional

information:

(a)

Depreciation has been charged (i) on Freehold

Buildings @ 2½% p.a. on cost Rs 10, 00,000. (ii) On Machinery and Plant Rs

32,000 (iii) on Fixtures and Fittings @5% on cost Rs 10,000. No depreciation

has been written off on newly acquired Building and Plant and Machinery.

(b)

A piece of land costing Rs 1, 00,000 was sold in 2016

for Rs 2, 50,000. The sale proceeds were credited to Land and Buildings.

(c)

Shares in other companies were purchased and dividends

amounting to Rs 6,000 declared out of profits made prior to purchase has

received and used to write down the investment (shares).

(d)

Goodwill has been written down against General

Reserve.

(e)

The proposed dividend for the year ended 30th

June 2015 was paid and, in additions, an interim dividend, Rs 52,000 was paid.

Solution: 5

Illustration: 6

The following is the Balance Sheets of the Android Industries Limited as at 31st December 2015 and 2016.

Balance sheet as at

|

|

Rs |

Rs |

|

Assets: |

31.12.2015 |

31.12.2016 |

|

Fixed assets: |

|

|

|

Property |

1,48,500 |

1,44,250 |

|

Machinery |

1,12,950 |

1,26,200 |

|

Goodwill |

- |

10,000 |

|

Current assets: |

|

|

|

Stock |

1,10,000 |

92,000 |

|

Debtors |

86,160 |

69,430 |

|

Cash at bank |

1,500 |

11,000 |

|

Pre-payments |

3,370 |

1,000 |

|

Total |

4,62,480 |

4,53,880 |

|

Liabilities: |

|

|

|

Shareholders’ funds: |

|

|

|

Paid up capital |

2,20,000 |

2,70,000 |

|

Reserves |

30,000 |

40,000 |

|

Profit and loss A/c |

39,690 |

41,220 |

|

Current liabilities: |

|

|

|

Creditors |

39,000 |

41,660 |

|

Bills payable |

33,790 |

11,000 |

|

Bank overdraft |

60,000 |

- |

|

Provision for taxation |

40,000 |

50,000 |

|

Total |

4,62,480 |

4,53,880 |

During the year ended 31st

December, 2016, a divided of Rs 26,000 was paid and assets of another company

were purchased for Rs 50,000 payable in fully paid-up shares. Such assets

purchased were:

Stock: Rs 21,640; Machinery: Rs

18,360; and Goodwill: Rs 10,000. In addition Plant at a cost of Rs 5,650 was

purchased during the year; depreciation on Property Rs 4,250; on Machinery Rs

10,760. Income tax during the year amounting to Rs 38,770 was charged to

provision for taxation. Net profit for the year before tax was Rs 76,300.

Prepare Funds Flow Statement for the

year 2016.

Solution: 6

Illustration: 7

The following are the Balance Sheets of Gamma Industries Limited for the year ending March 31, 2015 and March 31, 2016:

Balance sheet as at

|

|

Rs |

Rs |

|

Capital and liabilities: |

31.03.2015 |

31.03.2016 |

|

Share capital |

6,75,000 |

7,87,500 |

|

General reserves |

2,25,000 |

2,81,250 |

|

Capital reserve (profit on sale of

investment) |

- |

11,250 |

|

Profit and loss A/c |

1,12,500 |

2,25,000 |

|

15% Debentures |

3,37,500 |

2,25,000 |

|

Accrued expenses |

11,250 |

13,500 |

|

Creditors |

1,80,000 |

2,81,250 |

|

Proposed dividends |

33,750 |

38,250 |

|

Provision for taxation |

78,750 |

85,500 |

|

Total |

16,53,750 |

19,48,500 |

|

Assets: |

|

|

|

Fixed assets |

11,25,000 |

13,50,000 |

|

Less: Accumulated depreciation |

2,25,000 |

2,81,250 |

|

Net fixed assets |

9,00,000 |

10,68,750 |

|

Long- Term Investments (at cost) |

2,02,500 |

2,02,500 |

|

Stock (at cost) |

2,25,000 |

3,03,750 |

|

Debtors (net of provision for doubtful

debts of Rs 45,000 and Rs 56,250 respectively for 2015 and 2016) |

2,53,125 |

2,75,625 |

|

Bills receivable |

45,000 |

73,125 |

|

Prepaid expenses |

11,250 |

13,500 |

|

Miscellaneous expenditure |

16,875 |

11,250 |

|

Total |

16,53,750 |

19,48,500 |

Additional Information:

1.

During the year 2015-16, fixed assets with a net book

value of Rs 11,250 (accumulated depreciation, Rs 33,750) was sold for Rs 9,000.

2.

During the year 2015-16, Investments costing Rs 90,000

were sold, and also Investments costing Rs 90,000 were purchased.

3.

Debentures were retired at a Premium of 10%.

4.

Tax of Rs 61,875 was paid for 2015-16.

5.

During the year 2015-16, bad debts of Rs 15,750 were

written off against the provision for doubtful debts account.

6.

The proposed dividend for 2007-2008 was paid in

2015-16.

Required:

Prepare a Fund Flow Statement for the

year ended March 31, 2016.

Solution: 7

Very nice and helpful for my future exams.

ReplyDeleteThank you Utsav for your valuable comments. I am particularly happy to know that this article on Fund Flow Analysis helped you preparing for December, 2021 term exams.

ReplyDeletePlease keep on reading the articles published in this blog and upgrade your knowledge and concept about different topics of various subjects of your chosen courses. Of course, please don't forget to give your valuable comments after reading the articles.