COST ACCOUNTING

Reconciliation of

Cost and Financial Accounts

Part A: Presentation of formats of basic statements covering all the necessary details

Part B: Four Illustrations with Solutions

Part A

Statement showing reconciliation between

cost and financial accounts

|

Particulars |

Rs |

Rs |

|

Profit as per cost accounts |

|

|

|

ADD: |

|

|

|

(i) Over-recovery of overheads / Over-absorption of overheads /Over-application of overheads |

|

|

|

(ii) Items of

incomes not recorded in cost accounts (i.e. purely financial incomes, e.g.

interest income, dividend income, rent income, profits on sale of fixed

assets, profits on investments, transfer fees, etc.) |

|

|

|

(iii) Expenses not charged in financial accounts

(i.e. expenses charged in cost accounts only, e.g. notional rent of own

building, notional interest on own

capital, etc.) |

|

|

|

(iv)

Difference in the value of stock [(+A) as per working note below] |

|

|

|

|

|

|

|

LESS: |

|

|

|

(i) Under-recovery of overheads / Under-absorption of overheads / Under-application of overheads |

|

|

|

(ii) Expenses

not charged in cost accounts (i.e. expenses charged in financial accounts only, e.g. interest

on bank loan, interest on debenture, expenses and discount on issue of

shares/debentures, losses on sale of fixed assets, losses on investments,

fines, penalties, bad debts, goodwill written off, preliminary expenses

written off, loss by fire, income tax, donation, subscription, legal charges,

etc.) |

|

|

|

(iii)

Difference in the value of stock [(−A) as per working note below] |

|

|

|

Profit as per financial accounts |

|

|

Working note:

Computation of stock adjustment due to

difference in valuation

|

Particulars |

Closing Stock (Rs) |

Opening Stock (Rs) |

Increase in Stock (Rs) |

|

(1) |

(2) |

(3) |

(4)

= (2 − 3) |

|

As

per financial accounts |

××× |

××× |

××× |

|

LESS:

As per cost accounts |

××× |

××× |

××× |

|

|

××× |

××× |

××× (± A) |

Part B

Illustration: 1

During

a particular year, the auditors certified the financial accounts; showing

profit of Rs 1, 68,000

whereas the same, as per the costing books of accounts was coming out to be Rs

2, 40,000. Given the following information, you are asked to prepare a Reconciliation

Statement showing the reasons for the gap.

Trading and Profit and Loss Account

|

Particulars |

Rs |

Particulars |

Rs |

|

To

Opening stock |

8,20,000 |

By

Sales |

34,65,000 |

|

To

Purchases |

24,72,000 |

By

Closing stock |

7,50,000 |

|

To

Direct wages |

2,30,000 |

|

|

|

To

Factory overhead |

2,10,000 |

|

|

|

To

Gross Profit c/d |

4,83,000 |

|

|

|

|

42,15,000 |

|

42,15,000 |

|

To

Admn expenses |

95,000 |

By

Gross Profit b/d |

4,83,000 |

|

To

Selling expenses |

2,25,000 |

By

Sundry Income |

5,000 |

|

To

Net Profit |

1,68,000 |

|

|

|

|

4,88,000 |

|

4,88,000 |

The

costing records show:

i.

Book value of

closing stock Rs 7, 80,000.

ii.

Factory

overheads have been absorbed to the extent of Rs 1, 89,800.

iii.

Sundry income is

not considered.

iv.

Total absorption

of direct wages Rs 2, 46,000.

v.

Administrative

expenses are covered at 3% of selling price.

vi.

Selling prices

include 5% for selling expenses.

Illustration: 2

The

following is the Trading and Profit and Loss account of M/s. Time and Trading

limited for the year ended 31.12.2016.

Trading and Profit and Loss Account

|

Particulars |

Rs |

Particulars |

Rs |

|

To

Materials consumed |

7,08,000 |

By

Sales (30,000 units) |

15,00,000 |

|

To

Direct wages |

3,71,000 |

By

Closing stock of Finished Goods (1,000 units) |

40,000 |

|

To

Works overhead |

2,13,000 |

By

Work-in-progress: |

|

|

To

Admn overhead |

95,500 |

Materials |

17,000 |

|

To

S and D overhead |

1,13,500 |

Wages |

8,000 |

|

To

Net Profit |

69,000 |

Works overheads |

5,000 |

|

|

15,70,000 |

|

15,70,000 |

Manufacturing

a standard unit, the company’s cost records show that:

i. Works overheads

have been charged to works cost at 20% on prime cost.

ii.

Administration overheads

have been recovered at Rs 3 per finished unit.

iii.

Selling and

distribution overheads have been recovered at Rs 4 per unit sold.

iv. The unabsorbed

or over absorbed overheads have not been adjusted into costing profit and loss

account.

Prepare:

(a)

A Cost Sheet

indicating the Costing Profit, and

(b)

A Statement

Reconciling the Profit as disclosed by Cost Accounts and that shown in

Financial Accounts.

Illustration: 3

The financial profit and loss account of a manufacturing company for the year ended 31st March, 2017 is given below:

Trading and Profit and Loss Account

|

Particulars |

Rs |

Particulars |

Rs |

|

To

Opening stock: |

|

By

Sales |

4,60,000 |

|

Raw materials |

25,000 |

By

Closing stock: |

|

|

Finished goods |

40,000 |

Raw materials |

30,000 |

|

Work-in-progress |

12,500 |

Finished goods |

15,000 |

|

To

Purchases |

1,65,000 |

Work-in-progress |

20,700 |

|

To

Wages (Factory) |

30,000 |

|

|

|

To

Electric Power (Factory) |

65,000 |

|

|

|

To

Gross Profit c/d |

1,88,200 |

|

|

|

|

5,25,700 |

|

5,25,700 |

|

To

Admn expenses |

20,500 |

By

Gross Profit b/d |

1,88,200 |

|

To

Selling expenses |

46,500 |

By

Miscellaneous Revenue |

26,800 |

|

To

Debts declared bad |

15,600 |

|

|

|

To

Net Profit |

1,32,400 |

|

|

|

|

2,15,000 |

|

2,15,000 |

The cost

accounts of the concern showed a net profit of Rs 1, 11,700. It is observed that the costing profit has been arrived

at on the basis of the facts and figures as furnished below:

1. Opening stock of

raw materials, finished goods and work-in-progress Rs 90,800.

2.

Closing stock of

raw materials, finished goods and work-in-progress Rs 69,500.

3.

Miscellaneous revenue has not been considered in the

cost accounts.

You are

required to prepare a Memorandum Reconciliation Account and reconcile the

difference in the profit and loss account.

Illustration: 4

The

following figures have been extracted from financial accounts of a

manufacturing firm for the first year of its operation.

|

Particulars |

Rs |

|

Direct materials consumed |

50,00,000 |

|

Direct wages |

30,00,000 |

|

Factory overheads |

16,00,000 |

|

Administration overheads |

7,00,000 |

|

Selling and distribution overheads |

9,60,000 |

|

Bad debts |

80,000 |

|

Preliminary expenses written off |

40,000 |

|

Legal charges |

10,000 |

|

Dividends received |

1,00,000 |

|

Interest on deposit received |

20,000 |

|

Sales (1,20,000 units) |

1,20,00,000 |

|

Closing stock: |

|

|

Finished goods (4,000 units) |

3,20,000 |

|

Work-in-progress |

2,40,000 |

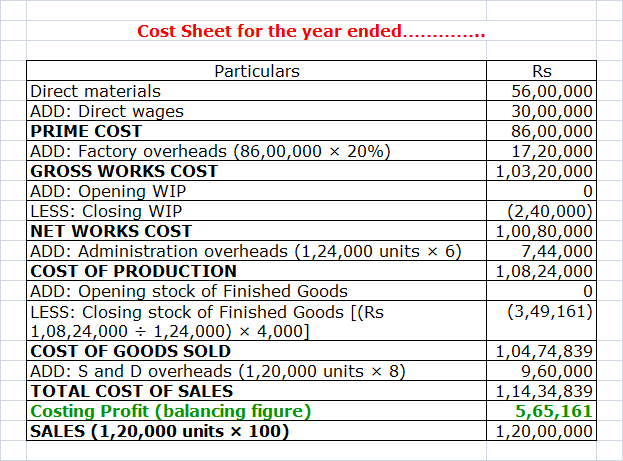

The cost

accounts for the same period reveal that the direct material consumption was Rs

56, 00,000. Factory OH is recovered

at 20% on prime cost; Administration OH is recovered @ Rs 6 per unit of

production; Selling and Distribution OH are recovered @ Rs 8 per unit sold.

You are

required to prepare a Cost Sheet and a Financial Profit and Loss Account and

reconcile the difference in the profit in the two sets of accounts.

Solution: 4

Helpful for my preparation of CMA Intermediate Group 1.

ReplyDelete