Cost Accounting

Operating Costing

Part A

Operating

costing is a method of costing applied to ascertain the cost of providing or

operating a service. Thus, the field of its application covers the undertakings

which do not manufacture any article, but provide or operate services.

Transport companies, electricity companies, hotels and resorts, tours and

travels, hospitals and nursing homes, restaurants, mobile operators, internet

service providers, banking companies, insurance companies, road/bridge/flyover

maintenance companies, educational institutions etc. are examples of the above

undertakings. A manufacturing company may maintain service departments like

transport department, maintenance department, power generation unit, canteen,

hospital etc. to provide services to the manufacturing, sales and welfare

activities of the concern. Operating costing may also be applied in these

service departments to ascertain the unit service cost.

Selection of

cost units, where operating costing is applied, requires careful consideration,

because cost unit will be different for different types of services. The

following are some of the cost units selected for different types of services:

|

|

Services |

Cost

units |

|

1. |

Passenger

transport service |

Passenger-kilometre |

|

2. |

Goods

transport service |

Tonne-kilometre |

|

3. |

Electricity

supply service |

Kilowatt-hour |

|

4. |

Hospitals |

Patient-day |

|

5. |

Canteen

service |

Man-meal |

|

6. |

Hotels |

Room-day |

One of the

important features of operating costing is that mostly such costs are fixed in

nature. For example, in case of passenger transport organization, most of the

costs are fixed while few costs like diesel and oil are variable and dependent

on the kilometres run.

Because of the diverse nature of activities carried out in service undertakings, the costing system used is obviously different from that of manufacturing concerns. Let us discuss and understand the methods of computing costs in various service organisations in course of solving the following selected operating costing illustrations.

Part B

Operating Costing

Selected Illustrations and Solutions

Illustration: 1

There are

two warehouses for storing finished goods produced in a factory. Warehouse ‘A’

is at a distance of 10 kms and Warehouse ‘B’ is at a distance of 15 kms from

the factory. A fleet of 5 tonne lorry is engaged in transporting the finished

goods from the factory. The records show that the Lorries average a speed of 30

kms per hour when running and regularly take 40 minutes to load at the factory.

At warehouse - A unloading takes 30 minutes per load while at warehouse - B it

takes 20 minutes per load.

Drivers’ Wages, depreciation, insurance and taxes

amount to Rs 18 per hour operated. Fuel oil, tyres, repairs and maintenance

cost Rs 2.40 per kilometre. You are required to draw up a statement showing the

cost per tonne kilometre of carrying the finished goods to the two warehouses.

Illustration: 2

Janata

Transport Co. has been given a route 20 km. long for running buses. The company

has a fleet of 10 buses each costing Rs 50,000 and having a life of 5 years

without any scrap value.

From the following estimated expenditure and other

details calculate the bus fare to be charged from each passenger.

|

1 |

Insurance

charges |

3%

p. a. |

|

2 |

Annual

tax for each bus |

Rs

1,000 |

|

3 |

Total

garage charges |

Rs

1,000 p. m. |

|

4 |

Driver’s

salary for each bus |

Rs

150 p. m. |

|

5 |

Conductor’s

salary for each bus |

Rs

100 p. m. |

|

6 |

Annual

repairs to each bus |

Rs

1,000 |

|

7 |

Total

commission of drivers and conductors |

10%

of total takings |

|

8 |

Cost

of stationery |

Rs

500 p. m. |

|

9 |

Manager’s

salary |

Rs

2,000 p.m. |

|

10 |

Accountant’s

salary |

Rs

1,500 p. m. |

|

11 |

Petrol

and oil |

Rs

25 per 100 km |

Each bus will

make 3 round trips carrying on an average 40 passengers on each trip. The bus

will run on an average for 25 days in a month. Assuming 15% profit on takings,

calculate, the bus fare to be charged from each passenger.

Illustration: 3

Union Transport Company supplies the following details

in respect of a truck of 5 tonne capacity:

|

1 |

Cost

of truck |

Rs

90,000 |

|

2 |

Estimated

life |

10

years |

|

3 |

Diesel,

oil, grease |

Rs

15 per trip each way |

|

4 |

Repairs

and maintenance |

Rs

500 p. m. |

|

5 |

Driver’s

wages |

Rs

500 p. m. |

|

6 |

Cleaner’s

wages |

Rs

250 p. m. |

|

7 |

Insurance |

Rs

4,800 per year |

|

8 |

Tax |

Rs

2,400 per year |

|

9 |

General

supervision charges |

Rs

4,800 per year |

The truck

carries goods to and from the city covering a distance of 50 kms each way.

On outward

trip freight is available to the extent of full capacity and on return 20% of

capacity.

Assuming

that the truck runs on an average 25 days a month, work out:

(a)

Operating cost per tonne-km.

(b)

Freight

per trip that the company should charge if a profit of 50% on freight is to be

earned.

Illustration 4

XYZ Ltd. runs a holiday home. For this purpose, it has

hired a building at a rent of Rs 10,000 per month along with 5% of total

taking. It has three types of suites for its customers, viz., single room,

double rooms and triple rooms. Following information is available:

|

Type

of suite |

Number |

Percentage

of occupancy |

|

Single

room |

100 |

100% |

|

Double

room |

50 |

80% |

|

Triple

room |

30 |

60% |

The rent of double-rooms suite is to be fixed at 2.5 times of the single-room suite and that of triple-rooms suite as twice of the double-rooms suite. The other expenses for the year 2018 are as follows:

|

Particulars |

Rs |

|

Staff

salaries |

14,25,000 |

|

Room

attendants’ wages |

4,50,000 |

|

Lighting,

heating and power |

2,15,000 |

|

Repairs

and renovation |

1,23,500 |

|

Laundry

charges |

80,500 |

|

Interior

decoration |

74,000 |

|

Sundries |

1,53,000 |

Provide profit @ 20% on total taking and assume 360

days in a year. Calculate the rent to be charged for each type of suite.

Illustration: 5

Angel Holiday Home runs in a small hill station with 100 single rooms. The home offers concessional rates during six off season months in a year. During this period, half of the full room rent is charged. The management’s profit margin is targeted at 20% of the room rent. The following are the cost estimates and other details for the year ending on 31st March 2018 [Assume a month as 30 days]:

(a)

Occupancy during the season is 80% while in the off-

season it is 40% only.

(b)

Total investment in the home is Rs 200 lakhs of which

80% relate to buildings and balance for furniture and equipment.

(c) Expenses:

|

Particulars |

Rs |

|

Staff

salary (excluding room attendants) |

5,50,000 |

|

Repairs

to building |

2,61,000 |

|

Laundry

charges |

80,000 |

|

Interior |

1,75,000 |

|

Miscellaneous

expenses |

1,90,800 |

Annual depreciation is to be provided for buildings @

5% and on furniture and equipment @ 15% on straight-line basis.

(d)

Room attendants are paid Rs 10 per room day on the

basis of occupancy of the rooms in a month.

(e)

Monthly lighting charges are Rs 120 per room, except

in four months in winter when it is Rs 30 per room and this cost is on the

basis of full occupancy for a month.

You are required to work out the room rent chargeable

per day both during the season and the off-season months on the basis of the

foregoing information.

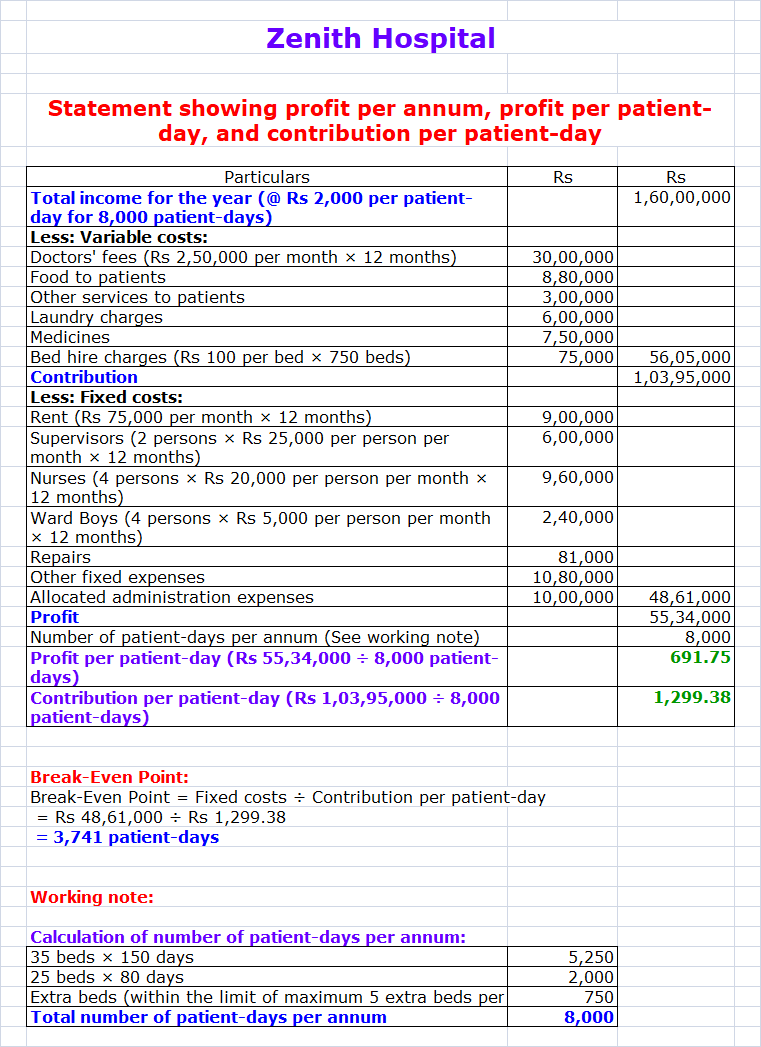

Illustration: 6

Zenith Hospital runs a Critical Care Unit (CCU) in a

hired building. CCU consists of 35 beds and 5 more beds can be added, if

required.

Rent per month: Rs 75,000

Supervisors - 2 persons @ Rs 25,000 per month each

Nurses - 4 persons @ Rs 20,000 per month each

Ward Boys - 4 persons @ Rs 5,000 per month each

Doctors were paid Rs 250,000 per month on the basis of number of patients attended and the time spent by them.

Other expenses for the year are as

follows:

1.

Repairs (fixed) – Rs 81,000

2.

Food to patients (variable) – Rs 8, 80,000

3.

Other services to patients (variable) – Rs 3,00,000

4.

Laundry charges (variable) – Rs 6,00,000

5.

Medicines (variable) – Rs 7,50,000

6.

Other fixed expenses – Rs 10, 80,000

7.

Administration expenses allocated – Rs 10,00,000

It was estimated that for 150 days in a year 35 beds

are occupied and 25 beds are occupied for 80 days only. The hospital hired 750

beds at a charge of Rs 100 per bed per day to accommodate the flow of patients.

However, this does not exceed more than 5 extra beds over and above the normal

capacity of 35 beds on any day.

You are required to -

(a)

Calculate profit per Patient day, If

the hospital recovers on an average Rs 2,000 per day from each patient; and

(b) Find out Break-even point for

the hospital.

Illustration: 7

Manar

lodging home is being run in a small hill station with 50 single rooms. The

home offers concessional rates during six off- season months in a year. During

this period, half of the full room rent is charged. The management’s profit

margin is targeted at 20% of the room rent. The following are the cost

estimates and other details for the year ending on 31st March 2016. [Assume a

month to be of 30 days].

1.

Occupancy during

the season is 80% while in the off- season it is 40% only.

2.

Expenses:

a. Staff salary [Excluding room attendants] Rs 2,

75,000

b. Repairs to building Rs 1, 30,500

c. Laundry and linen Rs 40,000

d. Interior and tapestry Rs 87,500

e. Sundry expenses Rs 95,400

3.

Annual depreciation is to be provided

for buildings @ 5% and on furniture and equipments @ 15% on straight-line

basis.

4.

Room attendants

are paid Rs 5 per room day on the basis of occupancy of the rooms in a month.

5.

Monthly lighting

charges are Rs 120 per room, except in four months in winter when it is Rs 30

per room and this cost is on the basis of full occupancy for a month.

6.

Total investment

in the home is Rs 100 lakhs of which Rs 80 lakhs relate to buildings and balance

for furniture and equipments.

You are required to work out the room rent chargeable

per day both during the season and the off-season months on the basis of the

foregoing information.

Solution: 7

No comments:

Post a Comment