Financial Accounting

Final Accounts of a

Non-Profit Organisation

Part A: Discussion of basic theories in regard to

methods of accounting for non-profit organisations including (1) definition,

meaning and accounting treatment of some important items like subscriptions,

entrance fees, donations, life membership fees, capital fund, etc., and (2) Format

of Subscription Account.

Part B: Eleven Illustrations with Solutions.

Introduction

Non-profit

organisation is an organisation which is set up for the benefit of the society

as a whole instead of for the benefit of any sole proprietor or any group of

partners or shareholders. Earning profit is not the motive of the non-profit

organisations rather their main objectives are providing social, educational,

religious or charitable benefits to the society at large. Examples of

non-profit organisation are club, charitable institution, charitable society,

charitable hospital, etc. Like any business organisation a non-profit

organisation also has to maintain its books of accounts throughout the

accounting year and at the end of the year has to prepare its own final

accounts.

Differences between a business

organisation and a non-profit organisation

The

major differences, from accounting point of view, between a business

organisation and a non-profit organisation are as follows:

1.

A business organisation is set up and exists for

earning profit, whereas a non-profit organisation is set up and

exists for rendering beneficial service

to the society without making any profit for any member of the organisation.

2. Final Accounts of a Business Organisation consist of trading account, profit and loss account and balance

sheet, whereas final accounts of a non-profit organisation

consist of receipts and payments account, income and

expenditure account and balance sheet.

3.

Profit and loss account of a business organisation is prepared to know

the net profit or loss made by the

organisation during the year, whereas income and expenditure account of a

non-profit organisation is prepared to know the surplus

(excess of income over expenditure) or deficiency

(excess of expenditure over income) at the end of the year.

4.

In case of the business organisation there is proprietor’s

capital which appears in the liability side of the balance

sheet, whereas in case of the non-profit organisation there is no such

proprietor’s capital. In fact, in case of the non-profit organisation there is capital fund which also appears in the

liability side of the balance sheet.

Difference

between Receipts and Payments Account and Income and Expenditure Account:

|

|

Receipts

& Payments A/c |

Income

& Expenditure A/c |

|

1 |

It is a summarised Cash Book |

It closely resembles the P/L A/c of a Trading concern. |

|

2 |

Receipts are debited and Payments are credited. |

Incomes are credited and Expenditures are debited. |

|

3 |

Transactions are recorded on Cash basis. |

Transactions are recorded on Accrual Basis |

|

4 |

Receipts and payments related to previous period and

future period are also recorded in this A/c along with receipts and payments

of current period. Outstanding amounts for current period are excluded. |

Incomes and expenditures of current period only are

recorded in this A/c. Outstanding amounts of current period are included. |

|

5 |

It records both Capital and Revenue transactions. |

It records Revenue transactions only. |

|

6 |

It is a Real Account in nature. |

It is a Nominal Account in nature. |

|

7 |

It starts with opening Cash and Bank Balances and

ends with closing Cash and Bank Balances. |

It does not record such balances; rather its final

balance shows a surplus or a deficit for the period. |

|

8 |

It does not record notional loss or non-cash expenses like bad debts, depreciations etc. |

It considers all such expenses for matching against revenues |

|

9 |

Its closing balance is carried forward to the same

A/c of the next period. |

Its closing balance is transferred to the Capital

Fund or General Fund or Accumulated Fund of the same

period’s B/S. |

|

10 |

It helps to prepare an Income & Expenditure A/c. |

It helps to prepare a Balance Sheet. |

Definition, meaning and accounting treatment

of some important items

CAPITAL

FUND

Capital

fund may be assumed to be the capital of non-profit organisation. It

represents:

(a)

Amount contributed by the supporters, members and well-wishers of the

organisation in cash or kind in the form of non-recurring general purpose donations;

(b)

Part of the entrance fees received from the members which have been

capitalised; and

(c)

Surplus (excess of income over expenditure) generated during the year.

If there is any deficiency (excess of expenditure over

income) at the end of the year it is deducted from the capital fund. Capital

fund (also known as general fund or accumulated fund) is shown in the liability

side of the balance sheet.

DONATION

It is the

amount contributed by the supporters, members and well-wishers of the

organisation in cash or kind. The donations may be

special purpose donations or general donations. Examples of special purpose donations are donations

received for prize, building, tournament, library, etc.

Special purpose donations are to be treated as capital

receipts and accordingly should be credited

to the particular fund for which the amount has been donated and should be

shown in the liability side of the balance sheet.

General donations may be of two types: non-recurring

and recurring. Non-recurring

donations received should be credited to Capital Fund, whereas recurring

donations received should be credited to Income & Expenditure Account.

LEGACY

It is an amount or other item of value received from a

deceased person under the terms of a will. It is directly added

to capital fund. If a legacy is received for any special

purpose, it should be credited to the particular fund for which the amount of

legacy has been received.

SUBSCRIPTIONS

It is the amount paid by the members at regular

intervals (monthly, quarterly, half-yearly or yearly) to keep their membership

alive. It is treated as income and credited to the

income and expenditure account of the period concerned.

LIFE

MEMBERSHIP FEE

It is a lump sum payment made by a member of an

organisation in order to become a life member of the organisation. There are

two alternative accounting treatments for the life membership fee.

Alternative: I

The entire amount of life membership fee received is credited to the capital fund.

Alternative:

II

The amount of life membership fee received is credited

to a special fund called life membership

fund and an amount equal to the annual subscription is

transferred every year to the income and expenditure account, the balance of

the fund being carried forward till it is fully exhausted. If any life member

dies before the entire amount paid by him has been transferred to the income

and expenditure account in the above way, the balance should be transferred to

the capital fund on the date of his death. In the absence of

any specific instruction in regard to which alternative treatment is to be

followed, the first alternative treatment should be followed.

ENTRANCE/ADMISSION

FEE

It is the fee paid by a member at the time of becoming

a member. It is paid by the member only once in life time for becoming a

member. In the absence of any specific instruction

entrance fee received should be treated as capital receipt and accordingly

credited to the capital fund. When

a specific direction has been given as to how much of the entrance fee received

should be treated as capital receipt and how much as revenue receipt, it should

be treated accordingly.

HONORARIUM

It is a token payment made to a person who has

voluntarily undertaken a service which would normally command a fee. It is thus

an expression of gratitude rather than a payment for the work done. It is treated as expense and debited to the income and

expenditure account of the period concerned.

SPECIAL

FUND

It is a fund set up for a special purpose. For

example, a cricket club may wish to organise annual cricket tournaments and may

set up a special fund for this purpose (may be by the name of “Tournament Fund”).

It should be noted that all the amounts received as donations or by fund

raising activities and all incomes relating to the special fund should be

credited to the special fund. Similarly, all expenses relating to the special

fund should be debited to the special fund. A special fund appears in the

liabilities side of the balance sheet. If the Special Fund is used to purchase

a fixed asset, the cost of the asset should be transferred from the Special

Fund to the Capital Fund by the following journal entry:

|

Date |

Particulars |

|

Debit (Rs) |

Credit (Rs) |

|

1 |

Special Fund A/c |

Dr |

|

|

|

|

To Capital Fund A/c |

|

|

|

|

|

(Cost of fixed asset

purchased transferred from the Special Fund to the Capital Fund) |

|

|

|

Accounting Treatment of Some Important Items

(Tabular Presentation):

|

ITEMS |

INCOME AND EXPENDITURE ACCOUNT |

BALANCE SHEET |

|

1. Donation |

|

|

|

Special

purposes donation |

|

Taken to balance sheet and added to the special fund

in the liability side |

|

General

donation |

|

|

|

Recurring |

Credited to I/E Account |

|

|

Non-recurring |

|

Credited to capital fund (i.e. added to capital

fund) |

|

2. Legacy |

|

Added to capital fund |

|

3. Subscription |

Credited to I/E Account |

|

|

4. Life Membership Fee |

|

|

|

1st

Alternative |

|

Credited to capital fund |

|

2nd

Alternative (by opening Life Membership Fund)

Note: In the absence of specific instruction about which

alternative is to be followed, always the first alternative should be

followed |

Every year total subscription of the year will be deducted

from the Life Membership Fund and will be credited to the I/E Account |

Credited to Life Membership Fund in the liabilities

side of the Balance Sheet

On death of a member, the balance left, if any, out

of his Life Membership Fee should be transferred to the Capital Fund from the

Life Membership Fund |

|

5. Entrance fee / Admission

fee |

If there is any specific instruction to treat a part

of the entrance fee as revenue receipt, that part of entrance fee should be

credited to I/E A/c. |

In the absence of any specific instruction, entrance

fee should be credited to capital fund in the Balance Sheet as capital

receipt.

|

|

6. Honorarium |

Treated as an expense and debited to I/E A/c |

|

|

7. Special fund /

Endowment fund [Examples: Tournament fund, prize fund, cultural

program fund, etc.] |

|

It is shown in the liability side of balance sheet.

All expenses relating to the special fund should be deducted from the special

fund and all incomes relating to the special fund should be added to the

special fund in the Balance Sheet.

If any fixed asset is purchased by using special

fund, cost of such asset should be transferred to capital fund from the special

fund. |

How to

calculate ‘income from subscriptions’ when ‘subscriptions received’ is given:-

Computation of income from subscriptions

|

|

Particulars |

Rs |

Rs |

|

|

Subscriptions received |

|

××× |

|

A: |

Outstanding subscriptions at the end of the year |

××× |

|

|

A: |

Subscriptions received in advance at the beginning

of the year |

××× |

|

|

A: |

Subscriptions written off during the year |

××× |

××× |

|

|

|

|

××× |

|

L: |

Outstanding subscriptions at the beginning of the

year |

××× |

|

|

L: |

Subscriptions received in advance at the end of the

year |

××× |

××× |

|

|

Income from subscriptions (Credited to the Income and Expenditure Account) |

|

××× |

How to

calculate ‘subscriptions received’ when ‘income from subscriptions’ is given:-

Computation of subscriptions received

|

|

Particulars |

Rs |

Rs |

|

|

Income from subscriptions |

|

××× |

|

A: |

Outstanding subscriptions at the beginning of the

year |

××× |

|

|

A: |

Subscriptions received in advance at the end of the

year |

××× |

××× |

|

|

|

|

××× |

|

L: |

Outstanding subscriptions at the end of the year |

××× |

|

|

L: |

Subscriptions received in advance at the beginning

of the year |

××× |

|

|

L: |

Subscriptions written off during the year |

××× |

××× |

|

|

Subscriptions received (Debited to the Receipts and Payments Account) |

|

××× |

Subscription

Account

‘Income from subscriptions’ and ‘Subscriptions

received’ can also be calculated as balancing figures by preparing Subscription

Account as follows:

Format of

Subscription Account in PDF

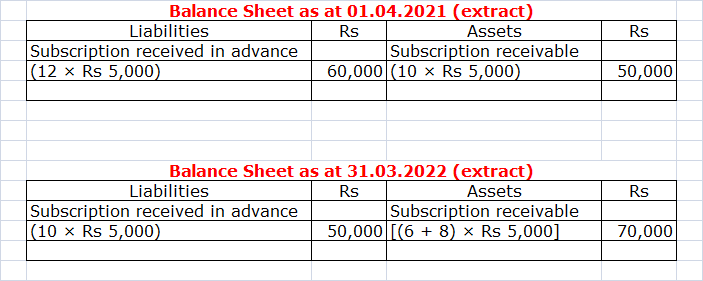

Example:

There are 100 members in a club. Subscription per

member per annum is Rs 5,000. For the current accounting year 2021-2022, 8

members could not pay their subscriptions, whereas 12 members paid their

current year’s subscriptions in the previous year. 10 members could not pay

their previous year’s subscriptions out of which 4 members cleared their dues

during the current year. 10 members paid their next year’s subscriptions during

the current year in advance.

Prepare

1.

Receipts and Payments A/c for the year ended 31.03.2022 (extracts);

2.

Income and Expenditure A/c for the year ended 31.03.2022 (extracts);

3.

Balance Sheet as at 1st April, 2021 (extracts); and

4.

Balance Sheet as at 31st March, 2022 (extracts).

Solution to Example

Part B

Financial Accounting

Accounting for

Non-Profit Organisation

Selected Problems and Solutions

Illustration:

1

The following summary of the Cash Book for the year 2012-13 has been

prepared by the treasurer of a club:

|

Receipts |

Rs |

Payments |

Rs |

|

To Balance b/d [As on 01.04.2012] |

4,740 |

By Wages |

13,380 |

|

To Subscriptions |

29,720 |

By Restaurant Purchases |

50,400 |

|

To Entrance Fees |

3,200 |

By Rent (For 18 months’ up to 30th June, 2,013) |

7,500 |

|

To Restaurant Receipts |

56,800 |

By Rates |

2,700 |

|

To Games and Competition Receipts |

13,640 |

By Secretary’s Salary |

3,120 |

|

To Due to Secretary for Petty Exp. |

80 |

By Lighting |

7,200 |

|

|

|

By Competition Prizes |

4,000 |

|

|

|

By Printing and Postage |

6,000 |

|

|

|

By Fixed Deposit |

8,000 |

|

|

|

By Balance c/d [As on 31.03.2013] |

5,880 |

|

|

1,08,180 |

|

1,08,180 |

On April 1, 2012

the club’s assets were: Furniture Rs 48,000, Restaurant stock Rs 2,600; Stock

of prizes Rs 800; Rs 5,200 was outstanding for supplies to the restaurant.

On March, 31, 2013,

the Restaurant stocks were Rs 3,000 and prizes in hand were Rs 500, while the

club owed Rs 5,600 for restaurant supplies.

It was also found

that subscriptions unpaid at March 31, 2013 amounted to Rs 1,000 and that the

figure of Rs 29,720 shown in the Cash Book included Rs 700 in respect of

previous year and Rs 400 paid in advance for the following year.

Prepare an account

showing the Profit or Loss made on the Restaurant and a General Income and

Expenditure Account for the year ended 31.3.2013 together with a Balance Sheet

as at that date after writing 10% off the Furniture.

Illustration:

2

‘Citizen Club’ was

registered in a city and the accountant prepared the following Receipts and

Payments Account for the year ended 31st Dec., 2013 and showed a

deficit of Rs 14,520:

|

|

(Rs) |

(Rs) |

|

Receipts: |

|

|

|

Subscriptions |

62,130 |

|

|

Fair Receipts |

7,200 |

|

|

Variety Show

Receipts (net) |

12,810 |

|

|

Interest |

690 |

|

|

Bar Collection |

22,350 |

|

|

Cash spent more |

1,000 |

1,06,180 |

|

Payments: |

|

|

|

Premises |

30,000 |

|

|

Honorarium to

Secretary |

12,000 |

|

|

Rent |

2,400 |

|

|

Rates and Taxes |

3,780 |

|

|

Printing and

Stationery |

1,410 |

|

|

Sundry Expenses |

5,350 |

|

|

Wages |

2,520 |

|

|

Fair Expenses |

7,170 |

|

|

Bar Purchase

Payments |

17,310 |

|

|

Repairs |

960 |

|

|

New Car (less

proceeds of old car Rs 9,000) |

37,800 |

1,20,700 |

|

Deficit |

|

14,520 |

The additional

information available is:

|

|

01.01.2013 |

31.12.2013 |

|

|

(Rs) |

(Rs) |

|

Cash in hand |

450 |

– |

|

Bank balance as

per pass book |

24,690 |

10,440 |

|

Cheques issued

but not presented for s/expenses |

270 |

90 |

|

Subscription due |

3,600 |

2,940 |

|

Premises at cost |

87,000 |

1,17,000 |

|

Accumulated

depreciation on premises |

56,400 |

– |

|

Car at cost |

36,570 |

46,800 |

|

Accumulated

depreciation on car |

30,870 |

– |

|

Bar Stock |

2,130 |

2,610 |

|

Creditors for Bar

Purchases |

1,770 |

1,290 |

Cash overspent

represents honorarium to secretary not withdrawn due to Cash deficit. His

annual honorarium is Rs 12,000. Depreciation on premises and car is to be

provided at 5% and 20% on written-down value.

You are required to

prepare the correct Receipts and Payments Account, Income and Expenditure

Account and Balance Sheet as at 31st Dec., 2013.

Illustration: 3

From the following

Trial Balance prepare Income & Expenditure A/c for the year ended

31-12-2013 and the balance sheet as on 31-12-2013 in the books of an Aryan

Education Society.

Trial Balance

|

Particulars |

Debit (Rs) |

Credit (Rs) |

|

Library Books |

2,30,000 |

|

|

Purchase of

Library Books |

52,200 |

|

|

Furniture |

1,59,500 |

|

|

Purchase of

Furniture |

35,500 |

|

|

Buildings |

37,89,000 |

|

|

Investments |

21,25,000 |

|

|

Creditors |

|

1,77,900 |

|

Debtors |

59,700 |

|

|

Investment

Reserve Fund |

|

1,85,000 |

|

Entrance Fees |

|

2,02,600 |

|

Examination Fees |

|

32,500 |

|

Certificate Fees |

|

7,800 |

|

Subscriptions

Received |

|

2,75,800 |

|

Hire Charges |

|

95,500 |

|

Interest |

|

85,000 |

|

Other Receipts |

|

4,400 |

|

Salary |

1,55,900 |

|

|

Printing and

Stationery |

8,500 |

|

|

Postage and

Telephone |

2,500 |

|

|

Insurance |

10,400 |

|

|

Examination

Expenses |

24,000 |

|

|

Periodicals |

15,600 |

|

|

Prizes Fund |

|

2,15,000 |

|

Prizes Fund Investments |

2,10,400 |

|

|

Prizes Investment

Income |

|

10,200 |

|

Prizes Given |

9,500 |

|

|

Prizes Bank

Balance |

2,450 |

|

|

Donations

(capital) |

|

1,99,000 |

|

General Expenses |

5,250 |

|

|

Capital Fund |

|

54,71,720 |

|

Bank Balance |

65,500 |

|

|

Cash in Hand |

1,520 |

|

|

Total |

69,62,420 |

69,62,420 |

Additional

information:

Subscription

receivable Rs 22,500, subscription received for 2014 Rs 7,850, Interest accrued

on investments Rs 6,250, salary outstanding for 2013 Rs 12,500, Prepaid

insurance Rs 4,500.

Depreciate Books @

15%, Building @ 1% and Furniture @ 10%.

Illustration:

4

From the following

Receipts and Payments Account prepare an Income and Expenditure Account for the

year ended 31.12.2016.

Receipts and Payments A/c

For the year ended

31.12.2016

|

Receipts |

Rs. |

Payments |

Rs. |

|

To Balance b/d: |

|

By Purchase of

furniture |

10,000 |

|

Cash in hand |

1,200 |

By Rent |

3,600 |

|

Cash at bank |

3,400 |

By Honorarium |

4,000 |

|

To Subscriptions |

24,500 |

By Salaries |

2,100 |

|

To Entrance Fees |

3,000 |

By Sports Exp. |

4,700 |

|

|

|

By Sundry Exp. |

1,100 |

|

|

|

By Printing and

Stationery |

800 |

|

|

|

By Balance c/d: |

|

|

|

|

Cash in hand |

1,700 |

|

|

|

Cash at bank |

4,100 |

|

|

32,100 |

|

32,100 |

Additional information:

|

|

31.12.2015 |

31.12.2016 |

|

|

(Rs) |

(Rs) |

|

Subscription due |

2,100 |

3,200 |

|

Subscription

received in advance |

1,400 |

2,700 |

|

Rent outstanding |

600 |

300 |

|

Salaries paid in

advance |

1,200 |

900 |

|

Furniture |

18,000 |

23,000 |

60 % of the

entrance fees are to be capitalized. Interest on savings bank account for Rs 280

has not been entered in the cash book. Old furniture (WDV Rs 8,000) was exchanged

at an agreed price of Rs 5,000 for a new furniture costing Rs 15,000.

Illustration:

5

The following

information was obtained from the books of Young Bengal Club as on 31-03-2013

at the end of first year of the club. Prepare the Receipts & Payments A/c,

Income & Expenditure A/c and Balance sheet of the club.

(1) Donations received

for Building & Books – Rs 2,00,000

(2) Other revenue

incomes and receipts were:

|

|

Incomes |

Receipts |

|

Entrance Fees |

17,000 |

17,000 |

|

Subscriptions |

20,000 |

19,000 |

|

Locker Rent |

600 |

600 |

|

Sundry Income |

1,600 |

1,060 |

|

Refreshment A/c |

Nil |

16,000 |

(3) Other revenue

expenditure and actual payments were:

|

|

Expenses |

Payments |

|

Land (Cost: Rs 10,000) |

Nil |

10,000 |

|

Furniture (Cost: Rs 1,46,000) |

Nil |

1,30,000 |

|

Salaries |

5,000 |

4,800 |

|

Maintenance of play ground |

2,000 |

1,000 |

|

Rent |

8,000 |

8,000 |

|

Refreshment A/c |

Nil |

8,000 |

Donations were

utilized to the extent of Rs 25,000 for buying books, balance were unutilized.

In order to keep it safe, 9% Govt. Securities were purchased on 31-3-2013 for

Rs 1, 60,000. Remaining amount was put in bank as term deposit on 31-3-2013.

Depreciate Furniture and books @ 10% for the whole year.

Illustration:

6

Following is the

Receipts and Payments A/c of Young Indians’ Club for the year ended 31-03-2013.

Receipts and Payments A/c

For the year ended 31.03.2013

|

Receipts |

Rs. |

Payments |

Rs. |

|

To Balance b/d: |

|

By Administrative

exp |

1,25,000 |

|

Cash in hand |

3,000 |

By Programme exp |

2,75,000 |

|

Cash at bank |

7,000 |

By FD with bank |

1,25,000 |

|

To Subscriptions

Received: |

|

By Investment in ICICI Bonds |

3,00,000 |

|

Up to 31.03.2012 |

14,000 |

By Fixed assets |

80,000 |

|

For 2012 – 13 |

1,50,000 |

By Balance c/d: |

|

|

For 2013 – 14 |

16,000 |

Cash in hand |

2,700 |

|

To Advertisements From Programme |

5,00,000 |

Cash at bank |

5,000 |

|

To FD with Bank |

75,000 |

|

|

|

To Interest on

Savings |

700 |

|

|

|

To Interest on FD |

22,000 |

|

|

|

To Sale of

tickets – Programme |

25,000 |

|

|

|

To Matured Govt. Security (Cost: Rs 80,000 and Interest: Rs 8,000) |

1,00,000 |

|

|

|

|

9,12,700 |

|

9,12,700 |

The club informs

you that:

(a)

Membership fee for 2012-13 due is Rs

25,000; and Rs 1,000 from a member who has not yet paid for 2011-12 as well. A

provision needs to be done on this.

(b)

Interest receivable on 31-03-2013 on

ICICI bond is Rs 30,000 and on Govt. Securities is Rs 24,000.

(c)

Prepaid administrative expenses on

31-3-2013 amounts to Rs 7,000.

(d)

Outstanding administrative expenses as

on 31-3-2013 Rs 8,000.

(e)

Depreciation to be provided is Rs 12,500.

(f)

Programme is an annual feature.

The Balance Sheet

as on 31-3-2012 is also provided as below:

Balance Sheet as at

31.03.2012

|

Liabilities |

Rs |

Assets |

Rs |

|

Trust Fund |

5,00,000 |

Cash in hand |

3,000 |

|

Accumulated

surplus |

1,05,000 |

Bank Account |

7,000 |

|

Subscriptions

received in advance |

10,000 |

Fixed Deposit |

2,00,000 |

|

Outstanding

Administrative Exp. |

10,000 |

Govt. Securities |

3,00,000 |

|

|

|

Fixed Assets |

95,000 |

|

|

|

Subscriptions

receivable |

15,000 |

|

|

|

Prepaid

Administrative Exp. |

5,000 |

|

|

6,25,000 |

|

6,25,000 |

Prepare Income and

Expenditure Account and the Closing Balance Sheet for the year 2012-13.

Illustration:

7

The following are

the items of Receipts and Payments of the Bengal Club as summarized from the

books of accounts maintained by the Secretary:

|

Receipts |

Rs |

Payments |

Rs |

|

Opening Balance

as at 1.1.2013 |

4,200 |

Manager’s Salary |

1,000 |

|

Entrance Fees

(2012) |

1,000 |

Printing and

Stationery |

2,600 |

|

Entrance Fees

(2013) |

10,000 |

Advertising |

1,800 |

|

Subscriptions

(2012) |

600 |

Fire Insurance |

1,200 |

|

Subscriptions

(2013) |

15,000 |

Investments

Purchased |

20,000 |

|

Interest Received

on Investments |

3,000 |

Closing Balance

as at 31.12.2013 |

7,600 |

|

Subscriptions

(2014) |

400 |

|

|

|

|

34,200 |

|

34,200 |

It was ascertained

from enquiry that the following represented a fair picture of the Income and

Expenditure of the Club for the year 2013 for audit purpose:

|

Expenditure |

Rs |

Rs |

Income |

Rs |

|

Manager’s Salary |

|

1,500 |

Entrance Fees |

10,500 |

|

Printing and

Stationery |

2,000 |

|

Subscriptions |

15,600 |

|

ADD: Outstanding |

400 |

2,400 |

Interest on Inv. |

4,000 |

|

Advertisement (no outstanding) |

|

1,600 |

|

|

|

Audit Fees |

|

500 |

|

|

|

Fire Insurance |

|

1,000 |

|

|

|

Depreciation |

|

4,940 |

|

|

|

Surplus |

|

18,160 |

|

|

|

|

|

30,100 |

|

30,100 |

You are required to

prepare the Balance Sheet of the Club as on 31.12.2012 and 31.12.2013, it being

given that the values of the Fixed Assets as on 31.12.2012 were: Building Rs

44,000, Cricket Equipment Rs 25,000 and Furniture Rs 4,000. The rates of depreciation

are: Building 5%, Cricket Equipments 10%, and Furniture 6%. (You are entitled

to make assumptions as may be justified.)

Click here for Solution: 7 in PDF

Illustration:

8

The Income and

Expenditure Account of the Calcutta Club is:

Income and Expenditure A/c

For the year ended

31.12.2013

|

Expenditure |

Rs |

Income |

Rs |

|

To Salaries |

1,750 |

By Subscriptions |

2,000 |

|

To General

Expenses |

500 |

By Donation |

1,050 |

|

To Depreciation |

300 |

|

|

|

To Surplus |

500 |

|

|

|

|

3,050 |

|

3,050 |

Adjustments are to

be made in respect of the following:

(1)

Subscription for 2012 unpaid at 1.1.2013

Rs 200; Rs 180 of which was received in 2013.

(2)

Subscription paid in advance at 1.1.2013

Rs 50.

(3)

Subscription paid in advance at

31.12.2013 Rs 40.

(4)

Subscription for 2013 unpaid at

31.12.2013 Rs 70.

(5)

Sundry Asset at the beginning of the

period Rs 2,600; Sundry Asset after depreciation Rs 2,700 at the end of the

period.

(6)

Cash balance at 1.1.2013 Rs 160.

Prepare a Receipts

and Payments Account.

Illustration:

9

Jodhpur Club

furnishes you the Receipts and Payments Account for the year ended 31.03.2013.

|

Receipts |

Rs. |

Payments |

Rs. |

|

To Balance b/d: |

|

By Salary |

20,000 |

|

Cash in hand |

40,000 |

By Repair

expenses |

5,000 |

|

Cash at bank |

1,00,000 |

By Furniture |

60,000 |

|

To Donations |

50,000 |

By Investments |

60,000 |

|

To Subscriptions |

1,20,000 |

By Misc. Expenses |

5,000 |

|

To Entrance Fees |

10,000 |

By Insurance

premium |

2,000 |

|

To Interest on Investments |

1,000 |

By Billiards

Table and other sports items |

80,000 |

|

To Interest from

banks |

4,000 |

By Stationery

exp. |

1,500 |

|

To Sale of old newspaper |

1,500 |

By Drama expenses |

5,000 |

|

To Sale of drama tickets |

10,500 |

By Balance c/d: |

|

|

|

|

Cash in hand |

26,500 |

|

|

|

Cash at bank |

72,000 |

|

|

3,37,000 |

|

3,37,000 |

Additional information:

(i)

Subscription in arrear for 2012-13 is Rs

9,000 and subscription in advance for the year 2013-14 is Rs 3,500.

(ii)

Rs 400 were the insurance premium

outstanding as on 31.03.2012.

(iii)

Miscellaneous expenses prepaid Rs 900.

(iv) 50% of donation is

to be capitalized.

(v)

Entrance fees to be treated as revenue

income.

(vi) 8% interest has

accrued on investments for five months.

(vii) Billiards table and

other sports equipments costing Rs 3,00,000 were purchased in the financial

year 2011-

12 and of which Rs

80,000 were not paid as on 31.03.12. There is no charge for depreciation to be

considered.

You are required to

prepare Income and Expenditure account for the year ended 31.03.13 and Balance Sheet

of the Club as at 31.03.13.

Illustration:

10

The Income and

Expenditure Account of the Bhartia Club for the year ended 31st

March, 2014 is as follows:

|

Expenditure |

Rs |

Income |

Rs |

|

To Salaries |

95,000 |

By Subscriptions |

1,50,000 |

|

To General

Expenses |

20,000 |

By Entrance Fees |

5,000 |

|

To Audit Fee |

5,000 |

By Collection

from Annual Sports |

65,000 |

|

To Printing and Stationery |

9,000 |

|

|

|

To Secretary’s Honorarium |

20,000 |

|

|

|

To Interest |

2,000 |

|

|

|

To Bank Charges |

1,000 |

|

|

|

To Depreciation on Sports Equipment |

6,000 |

|

|

|

To Expenditure on Annual Sports |

50,000 |

|

|

|

To Surplus |

12,000 |

|

|

|

|

2,20,000 |

|

2,20,000 |

Other Information:

|

Expenditure |

Rs |

|

Subscription

outstanding on 31.03.2013 |

12,000 |

|

Subscription

received in advance on 31.03.2013 |

9,000 |

|

Subscription

outstanding on 31.03.2014 |

15,000 |

|

Subscription

received in advance on 31.03.2014 |

5,400 |

|

Salaries

outstanding on 31.03.2013 |

8,000 |

|

Salaries

outstanding on 31.03.2014 |

9,000 |

|

Audit Fee

outstanding on 31.03.2013 |

4,000 |

|

Audit Fee

outstanding on 31.03.2014 |

5,000 |

|

General expenses

prepaid on 31.03.2014 |

1,200 |

|

Sports equipment

as on 31.03.2013 |

52,000 |

|

Sports equipment

after depreciation as on 31.03.2014 |

54,000 |

|

Other balances as on 31.03.2014: |

|

|

Freehold Ground |

2,00,000 |

|

Bank Loan |

40,000 |

|

Cash and Bank |

32,000 |

You are required to

prepare the Receipts and Payments Account for the year ended 31st

March, 2014 and Balance sheet as at 31st March, 2014.

Illustration:

11

Income and Expenditure Account and the Balance Sheet of

Nav Bharat Club are as under:

Income and Expenditure

Account

For the year ending

31.03.2012

|

Expenditure |

Rs |

Income |

Rs |

|

To Upkeep of

Ground |

21,000 |

By Subscriptions |

56,640 |

|

To Printing and Stationery |

2,800 |

By Sale of old newspaper |

530 |

|

To Salaries |

28,000 |

By Lectures |

8,000 |

|

To Depreciation on: |

|

By Entrance Fees |

2,900 |

|

Ground and

Building |

9,000 |

By Misc. Incomes |

1,200 |

|

Furniture |

1,000 |

|

|

|

To Repairs |

3,500 |

|

|

|

To Surplus |

3,970 |

|

|

|

|

69,270 |

|

69,270 |

Balance Sheet as at

31.03.2012

|

Liabilities |

Rs |

Rs |

Assets |

Rs |

|

Capital Fund: |

|

|

Ground and Building |

1,43,200 |

|

Opening balance |

1,56,430 |

|

Furniture |

9,000 |

|

ADD: Surplus |

2,900 |

|

Sports Prize Fund Inv. |

43,000 |

|

ADD: Entrance Fee |

3,970 |

1,63,300 |

Subscriptions receivable |

2,600 |

|

Sports Prize Fund: |

|

|

Cash and Bank |

19,400 |

|

Opening balance |

51,000 |

|

|

|

|

ADD: Interest |

4,500 |

|

|

|

|

|

55,500 |

|

|

|

|

LESS: Prizes |

6,500 |

49,000 |

|

|

|

Outstanding

salary |

|

4,200 |

|

|

|

Subscription recd in advance |

|

700 |

|

|

|

|

|

2,17,200 |

|

2,17,200 |

The following

adjustments have been made in the above accounts:

(i)

Upkeep of ground Rs 1,500 and printing

and stationery Rs 510 relating to 2010-2011 was paid in 2011-12.

(ii)

One-half of entrance fees have been

capitalized.

(iii)

Subscription outstanding in 2010-11 was

Rs 3,100 and for 2011-12 Rs 2,600.

(iv) Subscription received

in advance in 2010-11 was Rs 1,100 and in 2011-12 for 2012-13 Rs 700.

(v)

Outstanding salary on 31.03.2011 was Rs 3,600.

Prepare Receipts

& Payments Account for the year ended on 31st March, 2012.

Click here for Solution: 11 in PDF

No comments:

Post a Comment