FINANCIAL MANAGEMENT

Dividend Policy

Part A

Introduction and definition

Dividend is

paid out of net divisible profits to the shareholders (equity and preference).

Since preference shareholders are paid dividends at a stipulated rate as per

the terms and conditions of issuing preference shares, dividend policies

involve payment of dividend to equity shareholders only. Dividend policies are

again relevant to widely-held public limited companies only, because dividend

issue does not pose a major problem for closely-held private limited companies.

Dividend

policy refers to the policy regarding distribution of a portion of profits

among the shareholders i.e. whether to pay dividend to the equity shareholders

or retain the earnings instead of paying dividend. Therefore, there is a type

of reciprocal relationship between retained earnings and dividend payment as

follows:

(a) Larger retentions accompany

lesser dividends;

(b) Smaller retentions accompany

larger dividends.

Cost of equity capital, internal rate of

return and dividend pay-out ratio

Let cost of equity capital (i.e. required rate of return) is ‘ke’

and internal rate of return (i.e. expected rate of return) be ‘r’. If r > ke

earnings are retained and on the other hand, if r < ke earnings

are paid as dividends. In other words, dividend pay-out ratio (i.e. the ratio

of DPS to EPS expressed in %) varies from 0% to 100%. The ratio is 0% when no

dividend is paid at all; rather all the earnings are retained and invested into

abundantly available profitable projects. But the ratio is 100% when there are

no profitable opportunities and the entire earnings is paid out as dividends.

Dividend policy and maximisation of

shareholders’ wealth

Given the objective of financial management of maximising shareholders’

wealth the firm would take decision for payment of dividends instead of

retaining the earnings if it (the decision) increases the market price of the

equity shares as well as the total value of the firm. On the other hand, the

firm may also take decision not to pay dividends retaining the earnings for

investments into future projects if it (the decision) leads to increase in the

market price of the equity shares as well as the total value of the firm.

Different opinions/theories regarding

dividend policies

There are conflicting opinions regarding the impact of dividends on the

valuation of the firm. According to one such opinion payments of dividends is irrelevant

implying that the amount of dividends paid has no effect on the valuation of

the firm. On the other hand, there are certain other opinions according to

which payments of dividends are relevant implying that the value of

the firm measured in terms of the market price of the equity shares is impacted

by the dividend decision.

Irrelevance of dividends – MM Hypothesis

The most comprehensive argument in support of the irrelevance of

payments of dividends is provided by the MM (Modigliani – Miller) Hypothesis.

Under this hypothesis dividend policy has no effect on the share prices of the

firm and is, therefore, of no consequence. What matters according to this

hypothesis is the investment policy through which the firm can increase its

earnings and thereby the total market value.

Assumptions of MM Hypothesis

1. Capital markets are perfect

implying that –

(a) Securities are infinitely divisible,

(b) Investors are free to buy and sell securities and no investor is

large enough to influence the market price of the shares,

(c) There are no transaction costs and floatation costs,

(d) All investors are rational and behave accordingly,

(e) Each investor has the same information which is readily available free

of cost.

2. There are no taxes implying that there are no

differences in tax rates applicable to capital gains and dividends.

3. The firm has a given investment policy that does not change.

4. There is a perfect certainty by every investor

as to future investments and profits of the firm. In other words, investors are

able to forecast future prices of shares and dividends with certainty.

Relevance of dividends – Walter’s Model

Walter’s

model supports the doctrine that dividends are relevant. The choice of an

appropriate dividend policy affects the value of an enterprise. The firm would

have an optimum dividend policy which will be determined by the relationship of

‘r’ and ‘ke’.

If

a firm has adequate profitable investment opportunities, i.e. where r > ke,

it will be able to earn more than what the investors expect. Such firms may be

called growth firms. For growth firms the optimum dividend policy is:

0% dividend pay-out ratio. As per Walter’s model for such growth firms the

market value of the shares will be the maximum if the dividend pay-out ratio is

0%, i.e. if the firm retains the entire earnings for investing in future

profitable projects.

If

the firm does not have profitable investment opportunities i.e. where r < ke,

the shareholders will be better off if earnings are paid out to them so as to enable

them to earn a higher return by investing the funds elsewhere. In such a case

the market price of shares will be the maximum if the entire earnings are

distributed as dividends to the shareholders. For this type of firms the

optimum dividend policy is: 100% dividend pay-out ratio.

For

a firm where r = ke it is a matter of indifference whether earnings

are retained or distributed. In case of such firms, for all dividend pay-out

ratios (ranging from 0% to 100%) the market price of the shares will remain

constant. For such firms there is no optimum dividend policy.

Assumptions of Walter’s Model

1. All financing is done through retained

earnings. External sources of funds like debt or new equity capital are not

used.

2. With additional investments undertaken the

firm’s business risk does not change. It implies that ‘r’ and ‘ke’

are constant.

3. There is no change in the key variables namely,

Earnings per Share (EPS) and Dividend per Share (DPS) for a given value of the

firm.

4. The firm has perpetual life.

Relevance of dividends – Gordon’s Model

Gordon’s

model also supports the doctrine that dividends are relevant. The choice of an

appropriate dividend policy affects the value of an enterprise. As per the

Gordon’s model market price of equity shares and the value of the firm –

i.

Increases

as the dividend pay-out ratio increases, when r < ke

ii.

Decreases

as the dividend pay-out ratio increases, when r > ke

iii. Remains constant even if the dividend pay-out ratio

increases or decreases, when r = ke

Assumptions of

Gordon’s Model

1. The firm is an all-equity firm. New investment

projects are financed exclusively by retained earnings i.e., no external

financing is used for future investment purpose.

2. ‘r’ and ‘ke’ are constant.

3. The retention ratio (b) is constant. Therefore,

the growth rate (g = br) is also constant.

4. ke > br i.e., b < ke/r

(i.e., retention ratio must be less than the ratio of ke/r).

5. The firm has perpetual life.

Important formulas

|

|

|

|

|

|

MM Hypothesis |

|

|

1 |

P0 |

(D1 + P1) ÷ (1 + ke) |

|

2 |

P1 |

P0 (1 + ke) – D1 |

|

3 |

Δn |

[I – (E – nD1)] ÷ P1 |

|

4 |

V |

[(n + Δn) P1 – I + E] ÷ (1 + ke) |

|

5 |

V |

[n (P1 + D1)] ÷ (1 + ke) |

|

|

|

|

|

|

Walter’s Model |

|

|

6 |

P0 |

[D1 + r/ke (EPS1 –

D1)] ÷ ke |

|

|

|

|

|

|

Gordon’s Model |

|

|

7 |

P0 |

[EPS1 (1 – b)] ÷ (Ke – br) |

Meanings of abbreviations

|

|

|

|

|

1 |

P0 = |

Prevailing market price of equity share |

|

2 |

P1 = |

Market price of equity share at the end of the

current year |

|

3 |

D1 = |

Dividend per equity share at the end of the current year |

|

4 |

Ke = |

Cost of equity share capital (Also known as capitalisation rate and required rate of return on investment) |

|

5 |

n = |

Number of equity shares outstanding at the beginning

of the year |

|

6 |

Δn = |

Number of additional equity shares to be issued |

|

7 |

I = |

New investment |

|

8 |

E = |

Total earnings made during the current year |

|

9 |

EPS1 = |

Earnings per equity share at the end of the current year |

|

10 |

r = |

Expected rate of return on investment (Also known as

internal rate of return) |

|

11 |

b = |

Retention ratio |

|

12 |

V = |

Market value of the firm |

Part B

Illustration: 1

Sahu & Co. earns Rs 6 per share having capitalisation rate of 10 per

cent and an expected rate of return on investment of 20 per cent. According to

Walter’s Model, what should be the price per share at 30 per cent dividend

payout ratio? Is this the optimum dividend payout ratio as per Walter’s Model?

Solution: 1

Illustration: 2

X Ltd., has 8 lakhs equity shares outstanding at the

beginning of the year 2005. The current market price per share is Rs 120. The

Board of Directors of the company is contemplating Rs 6.40 per share as

dividend. The rate of capitalisation, appropriate to the risk-class to which

the company belongs, is 9.6%.

Based on M-M Approach, calculate

i. The market price of the share

of the company, when the dividend is - (a) declared; and (b) not declared.

ii. How many new shares are to be issued by the company, if the company desires to fund an investment budget of Rs 3.20 crores by the end of the year assuming that net income for the year will be Rs 1.60 crores?

Solution: 2

Illustration: 3

A Company pays a dividend of Rs 2.00 per share

with a growth rate of 7%. The risk free rate of return is 9% and the market

rate of return is 13%. The Company has a beta factor of 1.50. However, due to a

decision of the Finance Manager, beta is likely to increase to 1.75. Find out

the present value of the share before the decision as well as the likely value

of the share after the decision.

Solution: 3

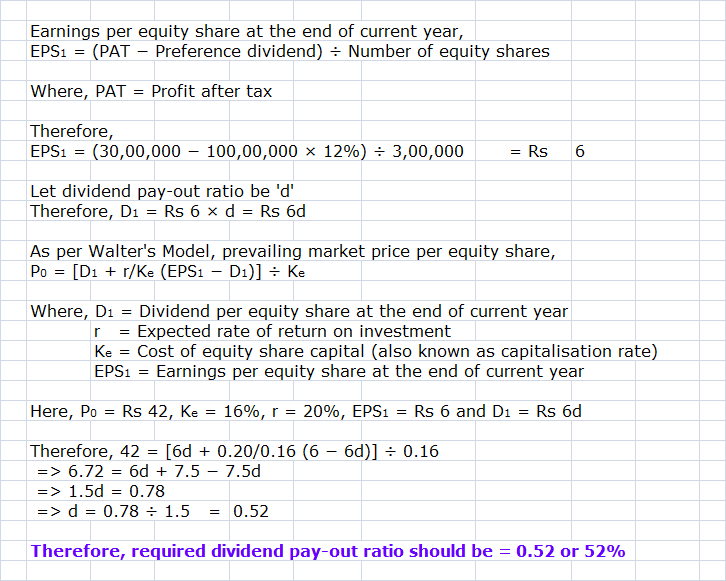

Illustration: 4

The following figures are collected from the annual

report of XYZ Ltd.:

|

Particulars |

Rs |

|

Net Profit |

30 lakhs |

|

Outstanding 12% preference shares |

100 lakhs |

|

No. of equity shares |

3 lakhs |

|

Return on Investment |

20% |

What should be the approximate

dividend pay-out ratio so as to keep the share price at Rs 42 by using

Walter’s Model? Capitalisation rate, appropriate to the risk-class to which the

company belongs, is 16%.

Solution: 4

Illustration: 5

The following information pertains to M/s XY Ltd.:

|

Earnings of the Company |

Rs

5,00,000 |

|

Dividend Payout ratio |

60% |

|

Number of equity shares outstanding |

1,00,000 |

|

Equity capitalization rate |

12% |

|

Rate of return on investment |

15% |

i. What should be the prevailing

market value per share as per Walter’s Model?

ii. What is the optimum dividend

payout ratio as per Walter’s Model and what should be the market value of

Company’s share at that payout ratio?

Solution: 5

Illustration: 6

ABC Limited has 50,000 outstanding

shares. The current market price of its share is Rs 100 each. It

hopes to make a net income of Rs 5, 00,000 at the end of current year. The

Company’s Board is considering a dividend of Rs 5 per share at the end of

current financial year. The company needs to raise Rs 10, 00,000 for approved

investment expenditure. The company belongs to a risk class for which the

capitalization rate is 10%. Show, how the M-M approach affects the value of

firm if the dividends are paid or not paid.

Solution: 6

Illustration: 7

The following information of Avatar Limited is supplied

to you:

|

Particulars |

Rs |

|

Total Earnings |

2,00,000 |

|

Number of equity shares (of

Rs 100 each) |

20,000 |

|

Dividend paid |

1,50,000 |

|

Price/Earnings (P/E) Ratio |

12.5 |

i. Ascertain whether the company

is following an optimal dividend policy.

ii. Find out what should be the P/E ratio at which the

dividend policy will have no effect on the value of the share.

Solution: 7

It is very informative and useful for all commerce students. I would like to have more such sort of aticles with same quality from this blog.

ReplyDelete