FINANCIAL MANAGEMENT

Receivables Management

Part A: Discussion of basic theories and various computation techniques for preparing the statement showing comparison of different credit policies in terms of their acceptability

Part B: 6 Illustrations with solutions

Part A

Definition of “receivables”

The

term “receivables” is defined as “debt owed to the firm by customers arising

from sale of goods or services in the ordinary course of business”. When a firm

makes an ordinary sale of goods or services and does not receive payment, the

firm grants trade credit to the customer and creates accounts receivable which

would be collected in the future. This is why receivables management is also

called “Trade Credit Management”. Thus, accounts receivable represent

an extension of credit to customers, allowing them a reasonable period of time

in which they are supposed to pay for the goods or services which they have

received.

Objective of receivables management

The

receivables represent an important component of the current assets of a firm.

The objective of receivables management is “to promote sales and profits until

that point is reached where the ROI [for the purpose of receivables

management, Return on investment (ROI) = (PAT ÷ Average investment in

receivables) x 100 %] in further funding of receivables is less than

the cost of funds raised to finance that additional credit (i.e., cost of

capital)”.

Specific costs

The

specific costs which are relevant to the receivables management are as follows:

1. Collection cost

These

are administrative

costs incurred in collecting the receivables from the customers to whom

credit sales are made. The types of costs included in this are:

a) Additional expenses on the creation and maintenance of a collection department

with staff, stationery, etc.

b) Expenses involved in acquiring credit information about the

customers either through outside agencies or by own staff.

2. Capital cost

The

increased level of accounts receivable is an investment in current assets

because receivables (i.e., debtors) are component of current assets. The firm

has to pay the employees and suppliers of raw materials and for that it has to

arrange additional funds while waiting for the payments to be received from the

customers. The cost of the use of these additional funds is the cost

of capital required to be incurred in order to extend credit to the customers.

This cost of capital may also be referred to as cost of debtors/receivables.

3. Delinquency cost

This

cost arises out of the failure of the customers to meet their obligations when

payments on credit sales become due after the expiry of the period of credit.

This cost includes costs associated with steps that might have to be taken to collect the over-dues,

for example, phone calls, reminder letters, legal notices, etc.

4. Default cost

The

firm sometimes may not at all be able to recover the over-dues because of the

inability of the customers. Such debts are treated as “bad debts” and have to

be written off as they cannot be realised. Such costs are known as default

cost.

Apart

from the above costs the amount of expected benefits achievable from a certain

credit policy is also an important factor that has a bearing on receivables

management. The benefits are in the form of increased amount of sales and

profits expected to be made out of a certain credit policy.

From

the above discussion it is clear that investment in receivables involves both

costs and benefits. The extension of trade credit has a major impact on sales,

costs and profitability. Other things being equal, a relatively liberal policy

and, therefore, higher investment in receivables, will produce larger sales.

However, costs will be higher with liberal policies than with more stringent

measures. Therefore, receivables management should aim at a trade-off between

profit (benefit) and risk (cost). That is to say, the decision to commit funds

to receivables will be based on a comparison of the benefits and costs involved

while determining the optimum level of receivables. The firm should only

consider the incremental (additional) benefits and costs that result from a

change in the receivables or trade credit policy.

Credit policies

There

are two types of credit policies adopted by the firms, which are:

1. Extending or reducing the credit period allowed

to the debtors; and

2. Allowing cash discount or where it is already there, increasing or

decreasing the rate of cash discount.

Average investment in debtors / receivables

Average investment in debtors / receivables can be calculated in three different ways according to three different situations as follows:

1. When total cost of sales (i.e., total variable cost + total fixed cost) is given in the problem or it can be computed from the given information in the problem, average investment in debtors will be calculated as follows:

Average investment in debtors

= (Total cost

of sales x Average collection period) ÷ 360

= Total cost

of sales ÷ Debtors turnover ratio

2. When the average investment in debtors cannot be

calculated in the above way, but variable cost percentage to sales is given in

the problem (total fixed cost is not given), average investment in debtors will

be calculated on the basis of total investment in debtors as follows:

Average investment in debtors

= (Total

investment in debtors x Average collection period) ÷ 360

= Total

investment in debtors’ ÷ Debtors turnover ratio

For this purpose:

i. Total

investment in debtors for existing credit policy = Total credit sales

ii. Total

investment in debtors for new credit policies

= Existing

credit sales + Variable cost of additional credit sales

3. When the average investment in debtors cannot be

calculated in any of the above two ways, it will be calculated as follows:

Average investment in debtors

= (Total

credit sales x Average collection period) ÷ 360

= Total

credit sales ÷ Debtors turnover ratio

Part B

Illustration: 1

XYZ Corporation whose current sales are in the region

of Rs 6 lakhs per annum and an average collection period of

30 days wants to pursue a more liberal policy to improve sales. A study made by

a management consultant reveals the following information:

|

Credit Policy |

Increase in collection period |

Increase in sales |

Payment default anticipated |

|

A |

10 days |

Rs

30,000 |

1.5% |

|

B |

20 days |

Rs

48,000 |

2% |

|

C |

30 days |

Rs

75,000 |

3% |

|

D |

45 days |

Rs

90,000 |

4% |

The selling price per unit is Rs 3. Average

cost per unit is Rs 2.25 and variable costs per unit are Rs 2. The current bad

debt loss is 1%. Required return on additional investment is 20%. Assume a 360

days year.

Which of the above policies would you

recommend for adoption?

Solution: 1

Illustration: 2

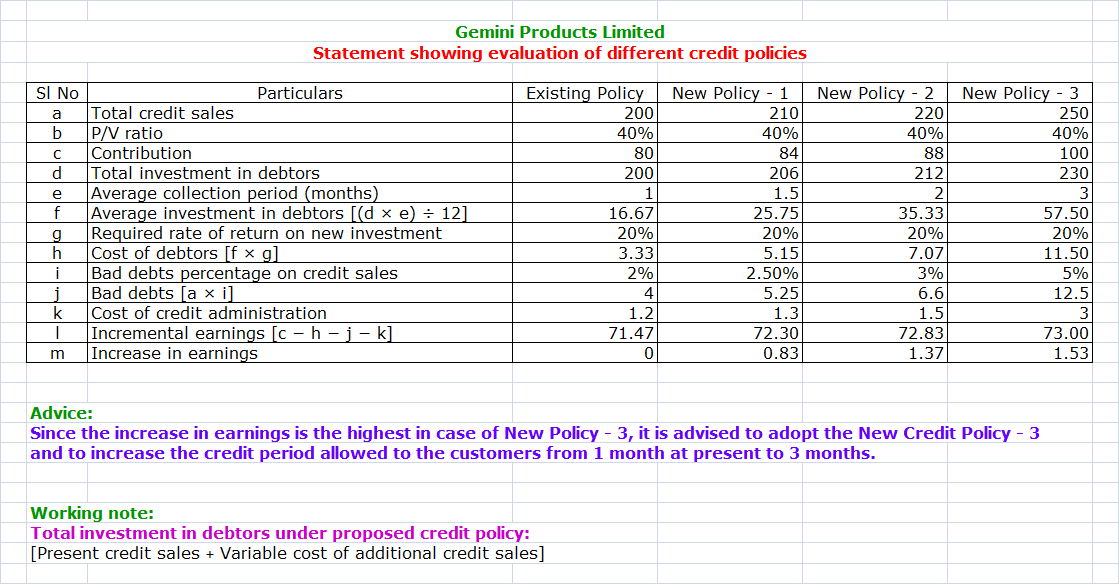

Gemini Products Ltd. is considering the revision of its credit policy with a view to increasing its sales and profits. Currently all its sales are on credit and the customers are given one month’s time to settle the dues. It has a contribution of 40% on sales and it can raise additional funds at a cost of 20% per annum. The marketing director of the company has given the following options with draft estimates for consideration.

|

Particulars |

Current position |

Option I |

Option II |

Option III |

|

Sales (Rs Lakhs) |

200 |

210 |

220 |

250 |

|

Credit period (months) |

1 |

1½ |

2 |

3 |

|

Bad debts (% of sales) |

2 |

2½ |

3 |

5 |

|

Cost of credit administration (Rs Lakhs) |

1.20 |

1.30 |

1.50 |

3.00 |

Advise the company to take the right decision.

Solution: 2

Illustration: 3

Surya Industries Ltd. is

marketing all its products through a network of dealers. All sales are on

credit and the dealers are given one month time to settle bills. The company is

thinking of changing the credit period with a view to increase its overall

profits. The marketing department has prepared the following estimates for

different periods of credit:

|

Particulars |

Present Policy |

Plan I |

Plan II |

Plan III |

|

Sales (Rs Lakhs) |

120 |

130 |

150 |

180 |

|

Credit period (months) |

1 |

1½ |

2 |

3 |

|

Bad debts (% of sales) |

0.5 |

0.8 |

1 |

2 |

|

Fixed costs (Rs Lakhs) |

30 |

30 |

35 |

40 |

The company has a contribution/sales

ratio of 40% further it requires a pre-tax return on investment at 20%.

Evaluate each of the above proposals and recommend the best credit period for

the company.

Solution: 3

Illustration: 4

The following are the details regarding the operations

of Rainbow Resorts Limited during a period of 12 months:

|

Sales |

Rs

12,00,000 |

|

Selling price per unit |

Rs

10 |

|

Variable cost per unit |

Rs

7 |

|

Total cost per unit |

Rs

9 |

Credit period allowed to customers one month. The firm is considering a proposal for a more liberal extension of credit which will result in increasing the average collection period from one month to two months. This relaxation is expected to increase the sales by 25% from its existing level.

You are required to advise the firm

regarding adoption of the new credit policy, presuming that the firm’s required

return on investment is 25%.

Solution: 4

Illustration: 5

Trinath Traders Ltd. currently sells on terms of next

30 days. All the sales are on credit basis and average collection period is 35

days. Currently, it sells 5, 00,000 units at an average price of Rs 50 per

unit. The variable cost to sales ratio is 75% and a bad debt to sales ratio is 3%.

In order to expand sales, the management of the company is considering changing

the credit terms from net 30 to ‘2/10, net 30’. Due to the change in policy,

sales are expected to go up by 10%, bad debt loss on additional sales will be

5% and bad debt loss on existing sales will remain unchanged at 3%. 40% of the

customers are expected to avail the discount and pay on the tenth day. The

average collection period for the new policy is expected to be 34 days. The

company required a return of 20% on its investment in receivables.

You are required to find out the

impact of the change in credit policy on the profit of the company. Ignore

taxes.

Solution: 5

Illustration: 6

The Piccadilly Company Limited currently sells on terms ‘net 45’. The company has sales of Rs 37.50 Lakhs a year, with 80% being the credit sales. At present, the average collection period is 60 days. The company is now considering offering terms ‘2/10, net 45’. It is expected that the new credit terms will increase current credit sales by 1/3rd. The company also expects that 60% of the credit sales will be on discount and average collection period will be reduced to 30 days. The average selling price of the company is Rs 100 per unit and variable cost is 85% of selling price. The Company is subject to a tax rate of 40%, and before-tax rate of borrowing of the Company for working capital is 18%.

Should the company change its credit

terms to ‘2/10, net 45’? Support your answers by calculating the expected

change in net profit. (Assume 360 days in a year)

Solution: 6

This airticle is very good and useful for all student

ReplyDelete