Cost Accounting

LABOUR COSTING

Introduction

Cost

accounting for labour has two primary objectives:

1.

Determining labour cost component in product cost or service cost; and

2.

Reporting labour cost for management planning and control.

Labour cost proportion of product cost or service cost may be,

sometimes, key consideration for pricing decisions and profitability analysis.

Cost accounting for labour also provides management with information necessary

for effective planning and control of human resources in producing goods and

services.

Direct and indirect labour

Direct labour cost is that portion of wages or salaries which can be

identified with and charged to a single cost unit. Labour cost will be

classified as direct cost when:

(a)

There is a direct relationship between the labour cost and the product

or process,

(b)

The labour cost may be measured in the light of this relationship, and

(c)

The labour cost is sufficiently material in amount.

Indirect labour costs are costs which are not identifiable with the

production of specific goods or services. These labour costs are usually

incurred in connection with production activities. Indirect labour costs

consist of labour costs incurred in service departments such as purchasing,

engineering and time-keeping. Labour costs of certain workers in the production

departments will also come in the category of indirect labour costs like labour

costs of foremen, material expediters and clerical assistants.

The auxiliary labour for store-room, factory office

and maintenance department will also be categorised as indirect labour. While direct labour cost forms part of prime cost,

indirect labour cost becomes part of overhead.

Methods of

remuneration and incentives

Important methods of remuneration and incentives may

be enumerated as follows:

1.

Time rate system,

2.

Straight piece rate system,

3.

Taylor’s differential piece rate system,

4.

Merrick’s differential piece rate system,

5.

Gantt task and bonus system,

6.

Emerson’s efficiency system,

7.

Halsey premium plan,

8.

Halsey-Weir premium plan,

9.

Rowan premium plan,

10.

Barth scheme,

11.

Group bonus system,

12.

Other incentive schemes.

TIME RATE SYSTEM

|

E = |

Rate per hour (day/week/month) x Hours (days/weeks/months) worked |

|

Where, E = |

Earnings |

STRAIGHT PIECE RATE SYSTEM

|

E = |

Rate per unit x Number of units produced |

TAYLOR’S DIFFERENTIAL PIECE RATE SYSTEM

|

For below

100% efficiency level: |

|

|

E = |

80% of piece rate x Number of units produced |

|

For at or

above 100% efficiency level: |

|

|

E = |

120% of piece rate x Number of units produced |

Important

notes:

Percentage of efficiency can be calculated in

following two ways:

|

1 |

Efficiency %-age = |

(TA ÷ TT) x 100 |

|

2 |

Efficiency %-age = |

(Actual output ÷ Standard output) x 100 |

|

Where, TA = |

Time allowed |

|

TT = |

Time taken |

MERRICK’S DIFFERENTIAL PIECE RATE SYSTEM

|

Efficiency |

Rate of payment |

|

Up to 83-1/3% |

Normal piece rate |

|

Above 83-1/3% but up to 100% |

110% of normal piece rate |

|

Above 100% |

120% of normal piece rate |

GANTT (HENRY LAURENCE GANTT) TASK AND BONUS SYSTEM

|

Output |

Rate of payment |

|

Below standard |

Normal time rate (guaranteed) |

|

At standard |

120% of normal time rate |

|

Above standard |

120% of normal piece rate |

EMERSON’S EFFICIENCY SYSTEM

|

Efficiency |

Rate of payment |

|

Below 662/3% |

Normal time rate (guaranteed) |

|

662/3% to 100% |

Normal time rate + Increasing bonus rate in

percentage as the efficiency percentage increases beyond 662/3% (Bonus rate can be increased up to 20%) |

|

Above 100% |

120% of normal time rate + 1% of Normal time rate

for every 1% increase in efficiency above 100% |

HALSEY

PREMIUM PLAN

|

E = |

Basic wage + Bonus |

|

E = |

TT x TR + 50% (TA – TT) x TR |

|

Where, TA = |

Time allowed |

|

TT = |

Time taken |

|

TR = |

Time rate (normal) |

Important

notes:

If in case

of a worker TT ≥ TA, the worker will not get any bonus, he will get only the

basic wage.

HALSEY-WEIR

PREMIUM PLAN

|

E = |

Basic wage + Bonus |

|

E = |

TT x TR + 33-1/3% (TA – TT) x TR |

|

Where, TA = |

Time allowed |

|

TT = |

Time taken |

|

TR = |

Time rate (normal) |

Important

notes:

If in case

of a worker TT ≥ TA, the worker will not get any bonus, he will get only the

basic wage.

ROWAN PREMIUM

PLAN

|

E = |

Basic wage + Bonus |

|

E = |

TT x TR + (TT ÷ TA) x (TA – TT) x TR |

|

Where, TA = |

Time allowed |

|

TT = |

Time taken |

|

TR = |

Time rate (normal) |

Important notes:

If in case of a worker TT ≥ TA, the worker will not get any bonus, he will get only the basic wage.

BARTH SCHEME

|

E = |

TR × [(TA × TT)^ ½ ] |

|

Where, TA = |

Time allowed |

|

TT = |

Time taken |

|

TR = |

Time rate (normal) |

Methods of measuring labour turnover

Labour turnover in an organisation is the rate of

change in the composition of the labour force during a specified period

measured against a suitable index. It is the rate at which employees leave

employment at a factory. Labour turnover has important implications for labour

cost, efficiency and productivity. The objective should be to keep labour

turnover at minimal.

The standard or usual labour turnover in the industry or

the labour turnover rate of a past period may be taken as the index or norm

against which actual labour turnover rate is compared.

There are four methods of calculating labour turnover

rate (LTR) as given below:

1.

Separation method

2.

Replacement method

3.

Flux method (when there are no new appointments on account of expansion)

4.

Flux method (when there are new appointments on account of expansion)

Labour Turnover Formulas:

|

1 |

LTR (Separation method) = |

(S ÷ A) × 100 |

|

2 |

LTR (Replacement method) = |

(R ÷ A) × 100 |

|

3 |

LTR (Flux method – when new appointments on account

of expansion are not included) = |

[(S + R) ÷ A] × 100 |

|

4 |

LTR (Flux method – when new appointments on account

of expansion are included) = |

[(S + R + N) ÷ A] × 100 |

Where,

|

S = |

Number of workers separated (i.e. left and discharged) during the

period |

|

R = |

Number of workers replaced (i.e. recruited in the vacancies) during

the period |

|

A = |

Average number of workers during the period |

|

A = |

½ (Number of workers at the beginning of the period + Number of

workers at the end of the period) |

|

N = |

Number of new workers appointed on account of expansion during the

period |

Important

notes:

New workers appointed on account of expansion are not to be included in

the number of replacements.

Treatment of

idle time cost in cost accounts

|

|

Causes of idle time |

Treatment |

|

1 |

(a) Time lost between the factory gate and the

department |

Not recorded separately |

|

(b) Personal needs, tea breaks |

||

|

(c) Machine set-up time, time break between two jobs |

||

|

2 |

(a) Waiting for job, materials, tools, power,

instruction, etc. |

Debited to factory overhead control account |

|

(b) Short machine breakdown, short load shedding |

||

|

3 |

(a) Prolonged machine breakdown, prolonged load

shedding |

Charged to costing profit and loss account |

|

(b) Strike, lock-out, natural calamity, etc. |

Treatment of

overtime wages in cost accounts

|

|

Causes of overtime |

Overtime Normal Wages Debited to |

Overtime Premium Debited to |

|

1 |

General pressure of work |

Wages control a/c |

Factory OH control a/c |

|

2 |

Customers’ specific request to expedite delivery |

Wages control a/c |

Wages control a/c |

|

3 |

Seasonal work pressure in a seasonal industry |

Wages control a/c |

Factory OH control a/c |

|

4 |

To avail of a special opportunity of the market |

Wages control a/c |

Wages control a/c |

|

5 |

Abnormal conditions like major breakdown, prolonged power-cut, natural

calamity, etc. |

Costing P/L a/c |

Costing P/L a/c |

|

6 |

To utilise the surplus perishable materials from one job in another

job |

Wages control a/c |

Factory OH control a/c |

Illustration: 1

Calculate

the total earnings and effective rate of earnings per hour of three operators

under Rowan System and

Halsey System from the following particulars.

The standard time fixed for producing 1 dozen articles

is 50 hours. The rate of wages is Rs 1/- per hour. The actual times taken by

the three operators are as follows:-

A – 45

hours

B – 40

hours

C – 30 hours.

Solution: 1

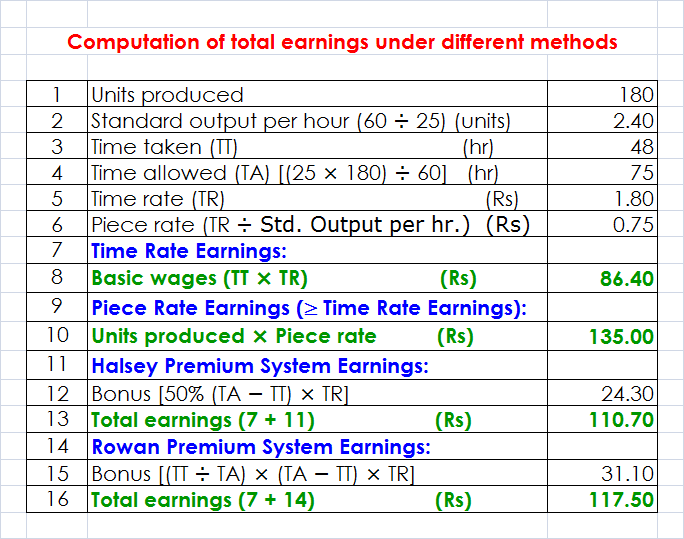

Illustration: 2

In a factory guaranteed

wages at the rate of Rs 1.80

per hour are paid in a 48 hour week. By time and motion study it is estimated

that to manufacture one unit of a particular product standard time is 20 minutes. The

time allowed (i.e. standard time per unit) is increased by 25% for the purpose of computing wages cost under different methods of remuneration and incentives. During the week A produced 180 units of the

product. Calculate his wages cost under the following methods:

(a)

Time

Rate

(b)

Piece

Rate with a guaranteed weekly wage

(c)

Halsey

premium Bonus

(d)

Rowan Premium Bonus

Solution: 2

Illustration: 3

Calculate the

earnings of workers A and B in a day of 8 hours under Straight Piece Rate

system and Taylor’s Differential Piece Rate system from the following

particulars:-

(a)

Normal rate per hour – Rs 1.80

(b)

Standard

time per unit – 20 seconds

(c)

Differentials

to be applied are:

1.

80%

of the piece rate below the standard;

2.

120%

of the piece rate at or above standard.

A produced

1,300 units and B produced 1,500 units in the day of 8 hours.

Solution: 3

Illustration: 4

The following

particulars apply to a particular job:

1.

Standard production per hour – 6

units

2.

Normal rate per hour – Rs 1.20

3.

In a day of 8 working hours -

(a)

Mohan produced 32 units,

(b)

Ram produces 42 units, and

(c)

Prasad produces 50 units.

Calculate the

wages of these workers for the day under Merrick Differential Piece Rate

System.

Solution: 4

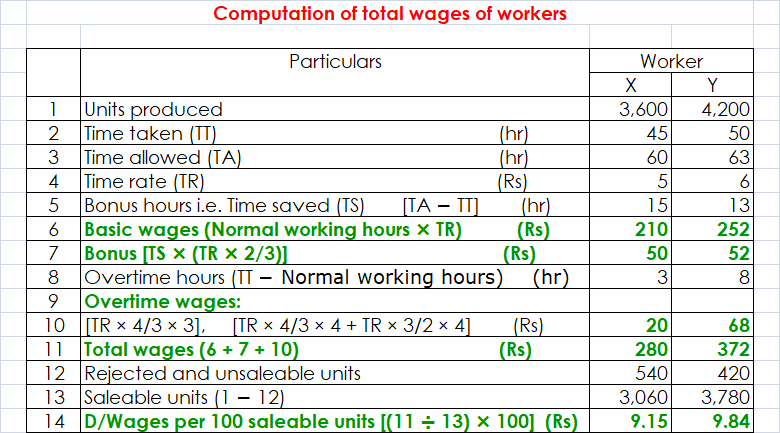

Illustration: 5

The following

particulars for the first week of September, 2015 relate to two workers X and Y

employed in a factory:

|

|

Particulars |

Worker: X |

Worker: Y |

|

(a) |

Units completed |

3,600 |

4,200 |

|

(b) |

Out of above units rejected and unsalable |

540 |

420 |

|

(c) |

Time allowed |

12 Mts./dozen |

3 Hrs./200 units |

|

(d) |

Basic wage rate per hour |

Rs 5 |

Rs 6 |

|

(e) |

Hours worked |

45 |

50 |

The normal

working hours per week are fixed at 42 hours. Bonus is paid @ 2/3 of the basic

wage rate for gross time saved in producing gross output without deduction for

rejected output. The overtime for the first 4 hours is paid at the rate of time

plus 1/3 and for the next 4 hours at the rate of time plus 1/2.

From the

above data calculate for each employee –

a)

Number of bonus hours and amount of

bonus earned;

b)

Total wages earned including basic

wages, overtime premium and bonus;

c)

Direct wages cost per 100 saleable

units.

Solution: 5

Illustration: 6

From

the following particulars work out the earnings for the week of a worker under

(a)

Straight Piece Rate

(b)

Differential Piece Rate

(c)

Halsey Premium System

(d)

Rowan System

|

1 |

Number of working hours per week |

48 |

|

2 |

Wages per hour |

Rs 3.75 |

|

3 |

Normal time per piece |

24 minutes |

|

4 |

Normal output per week |

120 pieces |

|

5 |

Actual output for the week |

150 pieces |

|

6 |

Differential piece rate (% of piece rate): |

|

|

|

When output is below standard |

80% |

|

|

When output is above standard |

120% |

Solution: 6

Illustration: 7

Ten

men work as a group. When the weekly production of the group exceeds standard

(200 pieces per hour) each man in the group is paid a bonus for the excess

production in addition to his wages at hourly rates. The bonus is computed

thus:

The

percentage of production in excess of the standard amount is found and one-half

of this percentage is considered as the men’s share. Each man in the group is

paid as bonus this percentage of a wage rate of Rs 3.20 per hour. There is no

relationship between the individual workman’s hourly rate and the bonus rate.

The following is the week’s records.

|

|

Hours Worked |

Production (units) |

|

Monday |

90 |

22,100 |

|

Tuesday |

88 |

22,600 |

|

Wednesday |

90 |

24,200 |

|

Thursday |

84 |

20,100 |

|

Friday |

88 |

20,400 |

|

Saturday |

40 |

10,200 |

|

|

480 |

1,19,600 |

(a)

Compute the rate and amount of bonus for the week;

(b) Compute

the total pay of Jones who worked 41 ½ hours and was paid Rs 2 per hour basic

and of Smith who worked 44 ½ hours and was paid Rs 2.50 per hour basic.

Solution: 7

Illustration: 8

A

manufacturer introduces new machinery into his factory with the result that

production per worker is increased. The workers are paid by results and it is

agreed that for every 2% increase in average individual output, an increase of

1% on the rate of wages will be paid as bonus.

At the time

the machinery is installed the selling price of the products falls by 8-1/3%.

Show the net saving in production costs which would be required to offset the

losses expected from the turnover and bonus paid to workers taking into

consideration the following further information provided by the manufacturer:

|

|

1st Period |

2nd Period |

|

Number of workers |

175 |

125 |

|

Number of articles produced |

16,800 |

14,000 |

|

Wages paid |

33,600 |

|

|

Total sales |

75,600 |

|

Solution: 8

Illustration: 9

The extracts

from the payroll of M/s. Maheswari Bros. is as follows:-

|

Number of employees at the beginning of 2015 |

150 |

|

Number of employees at the end of 2015 |

200 |

|

Number of employees resigned in 2015 |

20 |

|

Number of employees discharged in 2015 |

5 |

|

Number of employees replaced due to resignations and discharges |

20 |

Calculate the

Labour Turnover Rate for the factory by different methods.

Solution: 9

Illustration: 10

The

management of XYZ Ltd. is worried about the increasing Labour Turnover in the

factory and before analyzing the causes and taking remedial steps they want to

have an idea of the profit foregone as a result of Labour Turnover during the

last year. Last year’s sales amounted to Rs 83, 03,300 and the profit / volume ratio was 20%. The

total number of actual hours worked by the direct Labour force was 4.45 lakhs.

As a result of the delays by the Personnel department in filling vacancies due

to Labour Turnover, 1, 00,000 potentially productive hours were lost. The

Actual Direct Labour hours included 30, 000 hours attributable to training new

recruits, out of which, half of the hours were unproductive. The cost incurred

consequent on Labour turnover revealed on analysis the following:

|

Settlement cost due to

leaving |

Rs

43, 820 |

|

Recruitment costs |

Rs

26,740 |

|

Selection costs |

Rs

12,750 |

|

Training costs |

Rs

30,490 |

Assuming that

the potential production lost as a consequence of Labour Turnover could have

been sold at prevailing prices, find the profit foregone last year on account

of Labour Turnover.

Solution: 10

Illustration: 11

In

a factory bonus to workman is paid according to Rowan Plan. Time allotted for a

job is 40 hours and the normal rate of wages is Rs 1.25 per hour. The factory

overhead charges are 50 paise per hour for the hours taken.

The

factory cost of a work order executed by a worker is Rs 161.875. The cost of

material in each case is Rs 100.

Calculate

the hours of time taken by the worker to complete the work order.

Solution: 11

Illustration: 12

Two

workmen, Vishnu and Shiva, produce the same product using the same material.

Their normal wage rate is also the same. Vishnu is paid bonus according to the

Rowan System, while Shiva is paid bonus according to Halsey System. The time

allowed to make the product is 100 hours. Vishnu takes 60 hours while Shiva

takes 80 hours to complete the product. The factory overhead rate is Rs 10 per

man-hour actually worked. The factory cost for the product for Vishnu is Rs

7,280 and for Shiva it is Rs 7,600.

You

are required:-

(a)

To

find the normal rate of wages;

(b)

To

find the cost of materials;

(c)

To

prepare a statement comparing the factory cost of the products as made by the

two workmen.

No comments:

Post a Comment